Asbury Automotive: Discounted Stock In The Automotive Industry

skynesher/E+ via Getty Images

Asbury Automotive Group (NYSE:ABG) is a Fortune 500 company and remains one of the largest automotive retailers in the US, even after recent divestiture activity. The company has demonstrated a growing top-line, having sold over 300,000 new and used vehicles, an improvement from the previous year. ABG is also leveraging its online car buying platform, Clicklane, and Total Care Auto to bring a more diversified portfolio to its customers. These initiatives have helped the company make progress towards its long-term target of achieving $32 billion in total annual revenue by 2025. Given its strong performance and growth prospects, ABG is an attractive investment opportunity in my view, particularly during a potential pullback.

Company Overview

As one of the largest automotive retailers, ABG seems to remain very cautious and careful with its inventory buildup, suggesting that the company is focused on maintaining a strong financial position and maximizing profitability, which is a positive sign for investors. In fact, it achieved an all-time record revenue of $15,433.9 million, up 56.89{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from a year ago.

ABG divested 16 dealerships, which contributed a total of $683 million in FY’22. As a result, the total number of franchise dealerships decreased to 139 as of this writing. At the end of FY’22, the new vehicle inventory amounted to $254 million, while the used vehicle inventory amounted to $202 million. According to management, ABG experienced a slower used-to-new ratio, indicating that it sold more new vehicles than used vehicles during the period.

Our used to new ratio for the quarter was 101{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}, down from 108{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from the prior year quarter. Source: Q4 2022 Earnings Call Transcript

In fact, some experts believe today’s pent-up demand is expected to continue through 2023, despite the challenges faced by the auto sector, such as supply chain disruptions and a shortage of raw materials. This puts the company in a good position to benefit from the ongoing shift towards more sustainable and cleaner vehicles.

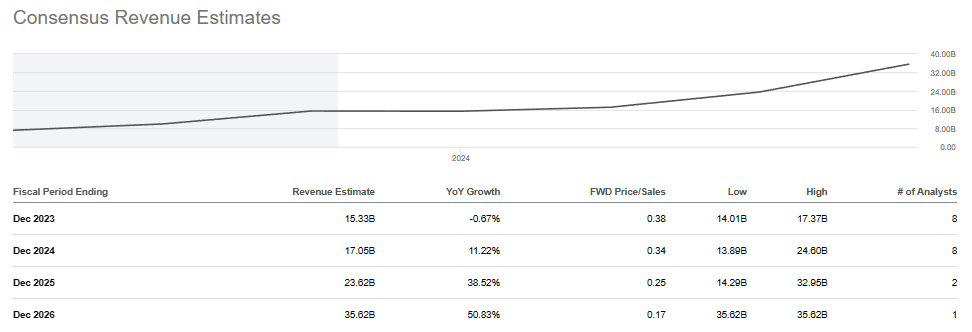

While the current inflationary environment is expected to impact ABG’s top line, analysts anticipate that any potential slowdown will probably not bring its revenue back down to pre-pandemic levels, as shown in the image below.

ABG: Growing Top Line Forecast (Source: Seeking Alpha Premium)

With its diversified portfolio, it is unsurprising to see this huge growth for ABG.

Shifting to F&I. We delivered another strong quarter with an F&I PBR of $2,233, an increase of $241 compared to the prior year quarter. In the fourth quarter, our total front-end yield per vehicle decreased on a year over year basis by $474 per vehicle to $5,984. Moving to parts and service. Our parts and service revenue increased 12{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in the quarter. Customer pay revenue built upon its momentum with a 13{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} growth and we expanded its gross profit by 14{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

Now turning to Clicklane. Please note that for Clicklane, we are reporting on an all store basis. As a reminder, this was the first quarter which included LHM in Stevenson sales since our full rollout. We sold an all-time record of over 8,400 vehicles through Clicklane in the fourth quarter, a 67{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} increase year-over-year and a 24{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} increase over the previous best, which was last quarter. For the full year 2022, we generated approximately $1.1 billion of revenue from Clicklane with over 27,500 vehicles sold via our fully transactional online tool. We expect to generate $2.5 billion in revenue for 2023 from Clicklane across all stores. A key differentiator for Clicklane is our loan marketplace, which works with 51 different lenders, banks and credit unions to give the consumer the power to select the finance offerings that are best for them. In the fourth quarter, we optimized our F&I menu to 2.0 by presenting a bundle of suggested products, which are tailored to the vehicle, the location and the customer’s usage. This allows the Clicklane consumer to be informed and let them select the best choices for protecting their asset. We are also adding functionality in the first half of 2023 to bring in new features, including enhanced integrations with OEM captive finance arms. Source: Q4 2022 Earnings Call Transcript

In fact, as quoted above, they are enhancing their platform, which may improve customer experience and eventually bring more customer loyalty and retention.

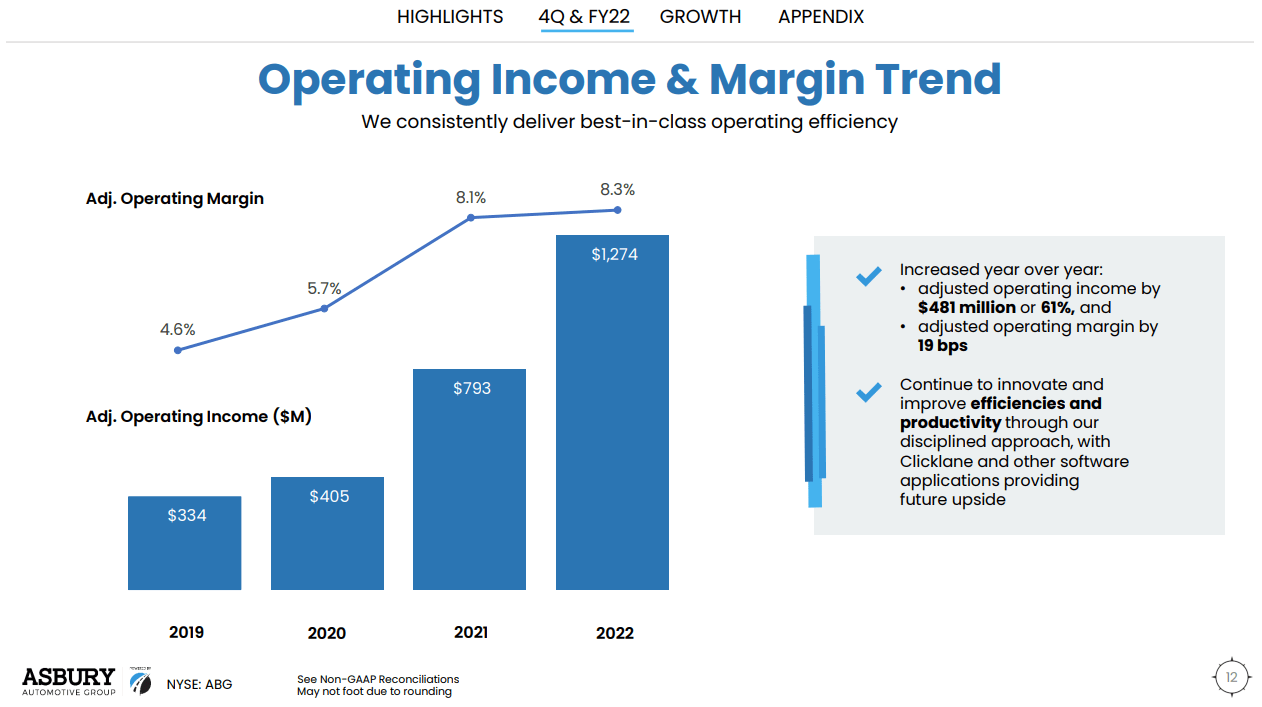

ABG: Growing Operating Margin (Source: Earnings Call Presentation)

The image above illustrates how management has been effectively controlling ABG’s operating margin growth. As depicted, ABG ended FY’22 with an operating margin of 8.3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}, which is better than its 3-year average of 6.13{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. This snowballed into improving adjusted free cash flow.

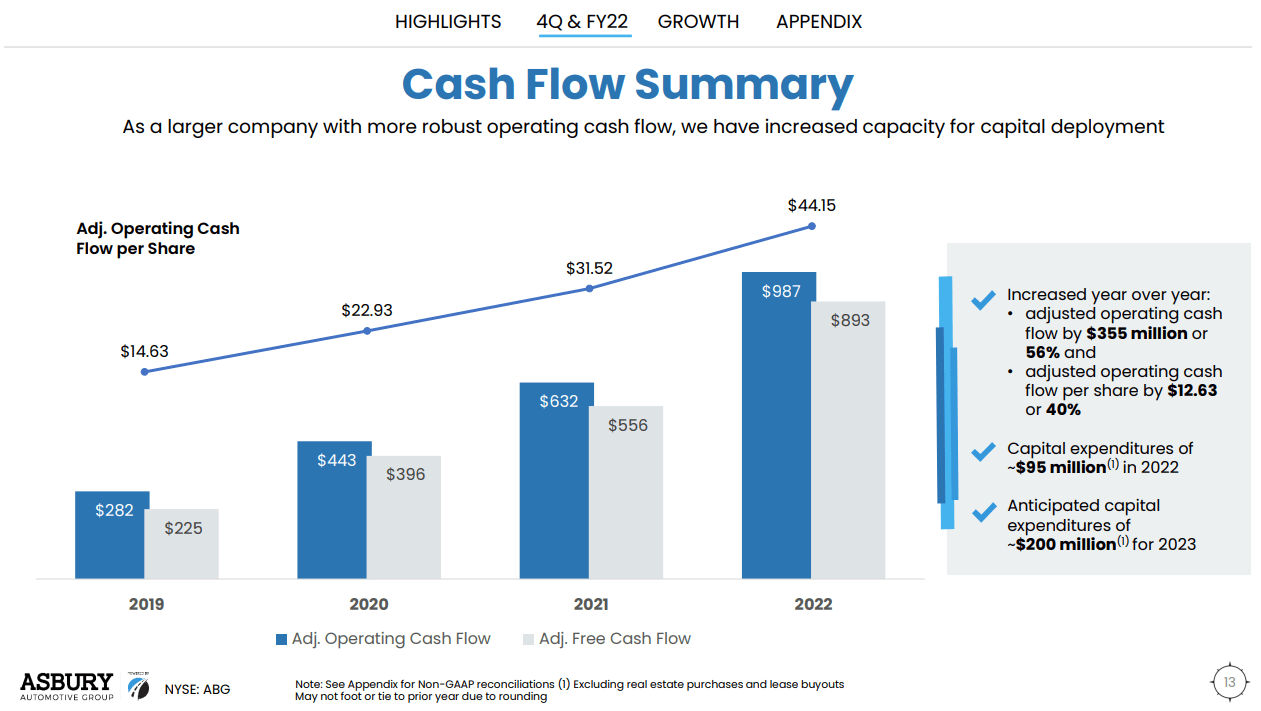

ABG: Growing Cash Flow (Source: Earnings Call Presentation)

Additionally, management provided a strong CapEx budget for FY’23 which should support achieving its long-term goal.

…We expect this to be approximately $200 million for the full year 2023 as we continued to plan CapEx related to our 2021 acquisitions. Of this $200 million, about $20 million is related to replacement of lease properties. Source: Q4 2022 Earnings Call Transcript

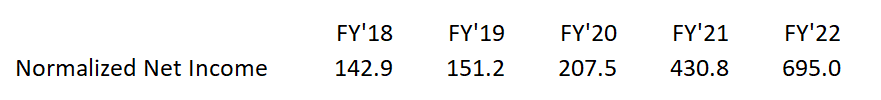

As a result of the divestiture, ABG incurred a net divestiture gain amounting to $207.1 million this year. Looking at the normalized net income of the company, we can see that it has been increasing, making it a more attractive investment opportunity.

ABG: Growing Normalized Net Income (Source: Data from Seeking Alpha. Prepared by the Author)

Buy the Pullback

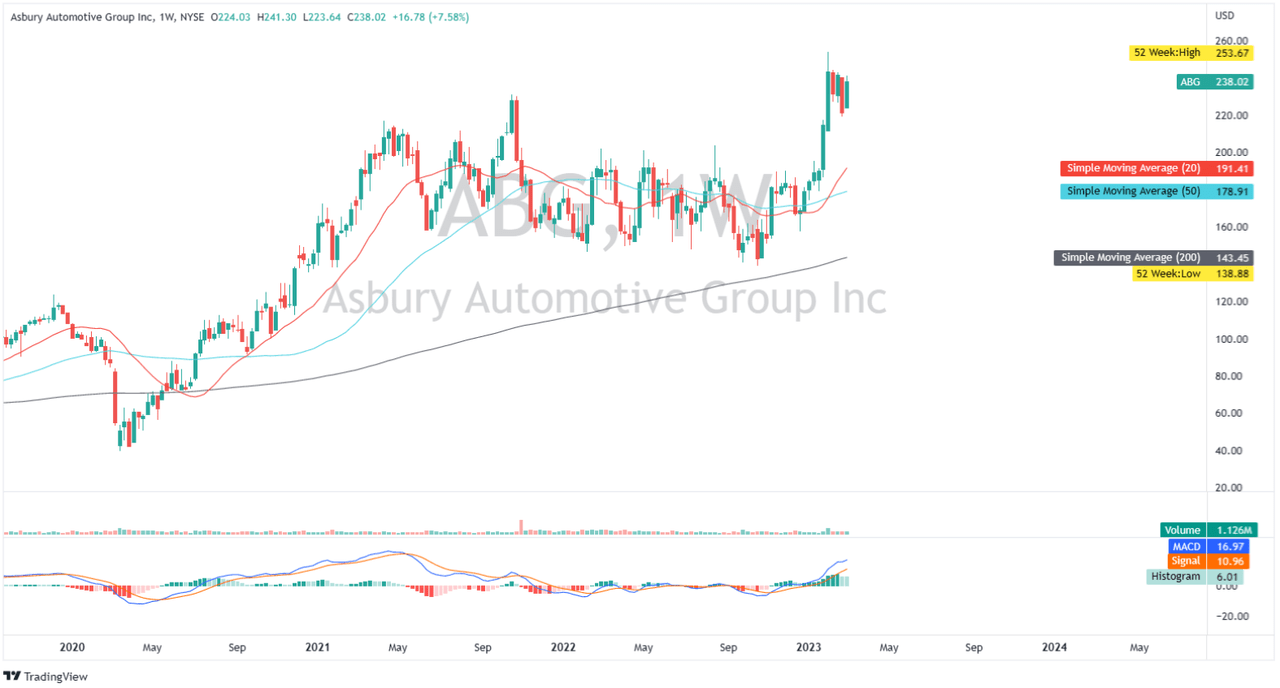

ABG: Weekly Chart (Source: Author’s TradingView Account)

ABG has experienced an impressive rally since its previous low in October thanks to its strong pricing mix, which has significantly improved the company’s profitability. It recently broke through its multi-year resistance zone around $230, but the price seems to be struggling at the moment, as shown in the chart above. This may suggest a potential pullback at today’s level, and the next key support levels to monitor are around $216 and $195. When looking at its simple moving averages (“SMA”), there is a strong buy sentiment, with the 20-day SMA trading above both the 50- and 200-day SMAs, as shown in the chart above. Therefore, any pullback after this breakout could provide a better entry point.

Discounted ABG

Despite the slowing top-line and earnings per share outlook mentioned earlier, ABG stock remains an attractive investment opportunity, particularly when considering its multiples. Its forward (Non-GAAP) P/E of 7.58x is currently lower than its 5-year average of 9.12x, indicating that the stock is undervalued. Additionally, ABG trades at a forward PEG ratio of 0.43, which is also attractive.

The positive sentiment extends to other valuation metrics as well. ABG’s forward EV/EBITDA of 7.65x is lower than its 5-year average of 9.36x, indicating that it is undervalued. Moreover, its forward P/CF of 8.78x is cheaper than its 5-year average of 13.45x. Finally, ABG is trading at a forward P/B of 1.60x compared to its 2.77x 5-year average, which further confirms that the stock is undervalued.

All of these valuation metrics suggest that ABG is currently trading at an attractive valuation, making it a good buy, especially if there is a potential pullback in the stock’s price.

Final Thoughts

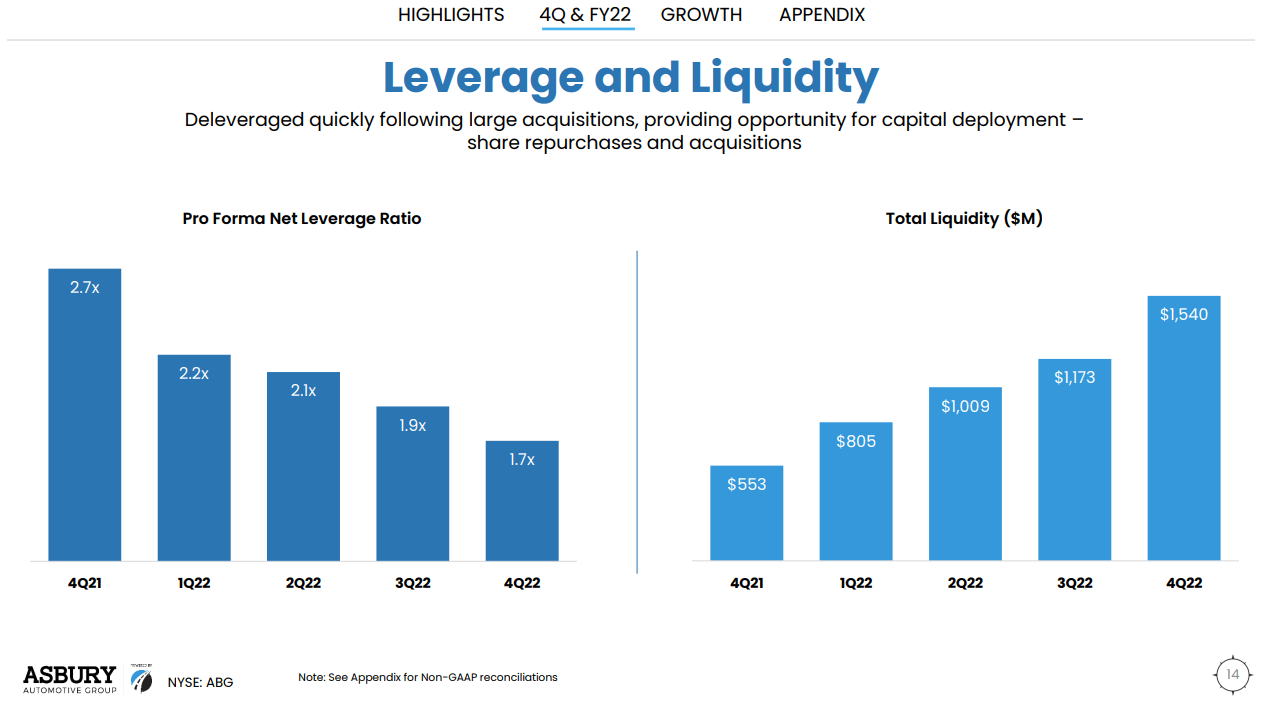

As shown in its growing adjusted free cash flow, ABG has also recorded an improvement in its total liquidity, which has contributed to its improving net leverage ratio, as shown in the image below.

ABG: Improving Liquidity (Source: Earnings Call Presentation)

Hence, with the liquidity available and no material long-term debt maturing before 2026, we can expect ABG to continue growing through acquisitions and start utilizing its authorized share buyback amounting to $200 million as of this writing. This makes Asbury Automotive fundamentally attractive and a potential buy candidate today, especially on any pullback.

Thank you for reading and good luck!