Bank of England delays bond sales, launches temporary purchase program

LONDON — The Financial institution of England will suspend the planned commence of its gilt providing next 7 days and start off quickly purchasing prolonged-dated bonds in buy to tranquil the current market chaos unleashed by the new government’s so-termed mini-price range.

Yields on U.K. govt bonds, acknowledged as “gilts,” have been on study course for their sharpest month to month increase considering the fact that at the very least 1957 as investors fled British mounted revenue markets subsequent the new fiscal plan bulletins. The steps provided huge swathes of unfunded tax cuts that have drawn international criticism, like from the IMF.

In a statement Wednesday, the central lender reported it was monitoring the “substantial repricing” of U.K. and worldwide assets in modern days, which has hit very long-dated U.K. government credit card debt specially really hard.

“Ended up dysfunction in this market place to continue or worsen, there would be a product chance to Uk financial steadiness. This would lead to an unwarranted tightening of financing disorders and a reduction of the move of credit history to the actual economy,” the Lender of England mentioned.

“In line with its fiscal steadiness goal, the Bank of England stands all set to restore market performing and reduce any pitfalls from contagion to credit circumstances for British isles households and enterprises.”

As of Wednesday, the lender will get started temporary buys of very long-dated U.K. federal government bonds in order to “restore orderly marketplace ailments,” and mentioned these will be carried out “on regardless of what scale essential” to soothe marketplaces.

The bank’s Financial Plan Committee on Wednesday acknowledged the dysfunction in the gilt industry posed a material chance to the country’s money balance, and opted to consider fast action.

The Monetary Policy Committee’s concentrate on of an yearly £80 billion ($85 billion) reduction of its gilt holdings remains unchanged, the financial institution stated, with the first gilt product sales — to begin with slated for Monday — now having area on Oct. 31.

A U.K. Treasury spokesperson confirmed that the procedure experienced been “absolutely indemnified” by the Treasury and mentioned that Finance Minister Kwasi Kwarteng is “dedicated to the Financial institution of England’s independence.”

“The Government will carry on to do the job closely with the Financial institution in aid of its monetary stability and inflation objectives,” the spokesperson extra.

The financial institution claimed it will publish a market see outlining the operational particulars of the program “shortly.”

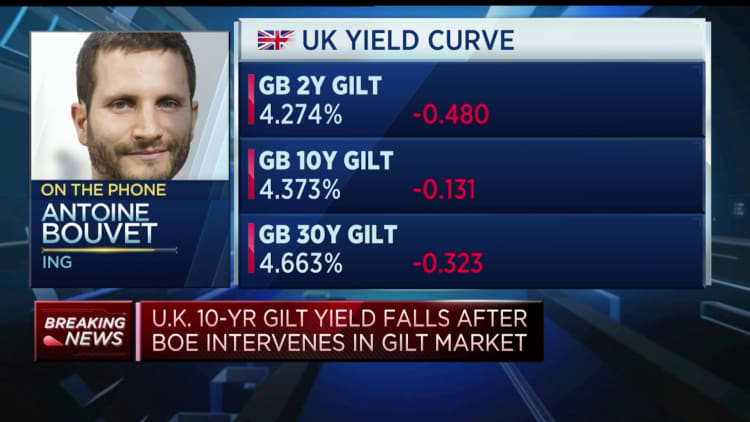

Yields on U.K. 30-yr gilts and 10-year gilts dropped sharply after the announcement, when sterling initially fell 1.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} against the greenback right before recovering a little bit to trade at around $1.066 by mid-afternoon in London.

‘Caught in a crossfire’

Antoine Bouvet, senior costs strategist at ING, stated that the Financial institution of England could have to have to lengthen the bond purchases over and above the first two-week period if volatility in the gilt sector carries on, and that an additional hike in curiosity prices was not off the table.

Bouvet instructed CNBC promptly after the announcement that the bank’s to start with precedence for now experienced to be the working of the gilt market place, suggesting the worst consequence would be for the sovereign to be left with no marketplace accessibility and not able to secure funding.

“Plainly the gilt marketplace was caught in a crossfire between the Financial institution of England and the Treasury, and it’s not precisely like that but it looked a large amount like they ended up competing, or operating at crossed functions,” Bouvet explained.

“So you have a entire world in which you have a economic downturn and the BOE is trying to amazing the financial system with hikes, and on the other hand you have the Treasury that is making an attempt to shield the economic system from that economic downturn and utilizing fiscal actions that are inflationary.”

He additional that the Treasury’s assertion of assistance was critical, noting that the federal government would be eager to keep away from the effect that the gilt current market is in “so substantially issues” that it had compelled the Bank of England to get keep of rescuing the overall economy.