Here is What You Should Know

Rivian Automotive (RIVN) has been a single of the most searched-for shares on Zacks.com currently. So, you may well want to glance at some of the specifics that could shape the stock’s functionality in the in close proximity to term.

Shares of this a manufacturer of motor autos and passenger automobiles have returned -26.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} above the earlier thirty day period as opposed to the Zacks S&P 500 composite’s -4.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} improve. The Zacks Automotive – Domestic field, to which Rivian Automotive belongs, has missing 5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} around this interval. Now the important dilemma is: Where by could the inventory be headed in the around term?

Despite the fact that media reviews or rumors about a considerable modify in a firm’s company prospects typically bring about its stock to craze and guide to an rapid price tag alter, there are generally particular fundamental elements that eventually travel the get-and-maintain decision.

Earnings Estimate Revisions

Relatively than concentrating on anything at all else, we at Zacks prioritize analyzing the transform in a firm’s earnings projection. This is since we believe the good price for its inventory is identified by the current benefit of its long run stream of earnings.

Our investigation is effectively based mostly on how promote-aspect analysts masking the inventory are revising their earnings estimates to choose the newest small business traits into account. When earnings estimates for a corporation go up, the truthful value for its inventory goes up as well. And when a stock’s truthful worth is higher than its present market price tag, buyers are inclined to get the stock, resulting in its cost moving upward. Since of this, empirical studies point out a potent correlation concerning tendencies in earnings estimate revisions and brief-time period inventory cost movements.

For the recent quarter, Rivian Automotive is anticipated to put up a loss of $1.37 per share, indicating a transform of +4.2{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from the yr-ago quarter. The Zacks Consensus Estimate has improved +.3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} more than the past 30 times.

For the present fiscal 12 months, the consensus earnings estimate of -$5.21 points to a transform of +17.8{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from the prior yr. In excess of the very last 30 times, this estimate has altered -4.4{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

For the future fiscal yr, the consensus earnings estimate of -$3.41 suggests a adjust of +34.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from what Rivian Automotive is envisioned to report a calendar year in the past. Around the past thirty day period, the estimate has modified +14.7{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

With an amazing externally audited keep track of document, our proprietary stock rating resource — the Zacks Rank — is a extra conclusive indicator of a stock’s close to-expression selling price performance, as it proficiently harnesses the energy of earnings estimate revisions. The dimension of the recent improve in the consensus estimate, together with three other things associated to earnings estimates, has resulted in a Zacks Rank #3 (Keep) for Rivian Automotive.

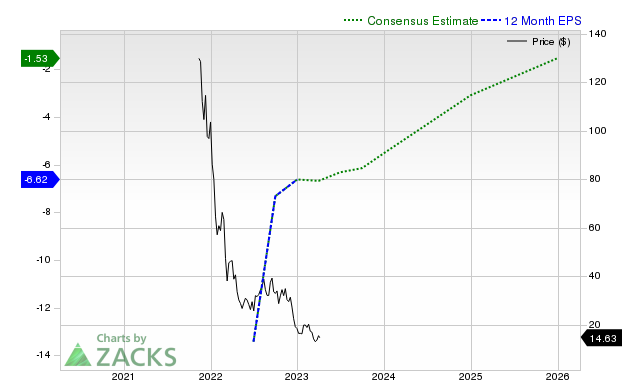

The chart under displays the evolution of the company’s ahead 12-thirty day period consensus EPS estimate:

12 Thirty day period EPS

Income Development Forecast

Though earnings development is arguably the most remarkable indicator of a company’s economical wellbeing, very little transpires as these types of if a organization isn’t really in a position to grow its revenues. Immediately after all, it’s nearly unattainable for a firm to improve its earnings for an extended period devoid of growing its revenues. So, it can be critical to know a company’s prospective revenue expansion.

In the scenario of Rivian Automotive, the consensus gross sales estimate of $711.98 million for the current quarter details to a calendar year-about-yr transform of +649.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. The $4.52 billion and $9.6 billion estimates for the present-day and upcoming fiscal a long time show modifications of +172.6{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} and +112.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}, respectively.

Final Reported Effects and Shock History

Rivian Automotive noted revenues of $663 million in the very last reported quarter, symbolizing a calendar year-more than-calendar year alter of +1127.8{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. EPS of -$1.73 for the same period of time compares with -$2.43 a year back.

When compared to the Zacks Consensus Estimate of $713.8 million, the documented revenues characterize a surprise of -7.12{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. The EPS surprise was +8.47{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

About the very last 4 quarters, Rivian Automotive surpassed consensus EPS estimates a few situations. The company topped consensus profits estimates two situations around this period of time.

Valuation

No expense final decision can be productive with no looking at a stock’s valuation. Irrespective of whether a stock’s current selling price rightly displays the intrinsic worth of the underlying business enterprise and the company’s growth prospective clients is an crucial determinant of its long term price tag effectiveness.

Comparing the present price of a firm’s valuation multiples, these as its cost-to-earnings (P/E), price-to-profits (P/S), and cost-to-funds stream (P/CF), to its own historic values aids ascertain no matter if its stock is pretty valued, overvalued, or undervalued, while comparing the enterprise relative to its peers on these parameters gives a good feeling of how realistic its inventory cost is.

As section of the Zacks Model Scores procedure, the Zacks Value Fashion Rating (which evaluates both of those regular and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is far better than B B is superior than C and so on), making it beneficial in pinpointing irrespective of whether a stock is overvalued, rightly valued, or quickly undervalued.

Rivian Automotive is graded F on this front, indicating that it is buying and selling at a quality to its friends. Simply click in this article to see the values of some of the valuation metrics that have driven this grade.

Conclusion

The specifics reviewed listed here and considerably other data on Zacks.com could possibly aid establish whether or not it’s worthwhile paying notice to the market excitement about Rivian Automotive. Nonetheless, its Zacks Rank #3 does advise that it might conduct in line with the broader market place in the near term.

Want the hottest tips from Zacks Financial investment Study? Nowadays, you can obtain 7 Greatest Stocks for the Following 30 Times. Click on to get this totally free report

Rivian Automotive, Inc. (RIVN) : Free of charge Inventory Investigation Report