Bringing the United States Economy Back into Balance

Bringing the US Economy Back again into Stability

By Andrew Hodge

IMF Western Hemisphere Division

February 16, 2023

The US Federal Reserve has been increasing desire costs to restore price tag stability and to carry stability to the labor marketplace. The desire for new hires is exceeding the provide of readily available personnel in the US, as the unemployment price has fallen to its most affordable stage in about 50 several years, and this has contributed to increased inflation. To support provide the overall economy back into stability, IMF analysis displays that being the system and preserving interest prices elevated this calendar year will tame inflation. While these higher costs will temporarily enhance unemployment, they will pave the way for secure inflation and sustainable economic growth, which will eventually assist create additional careers in the long run.

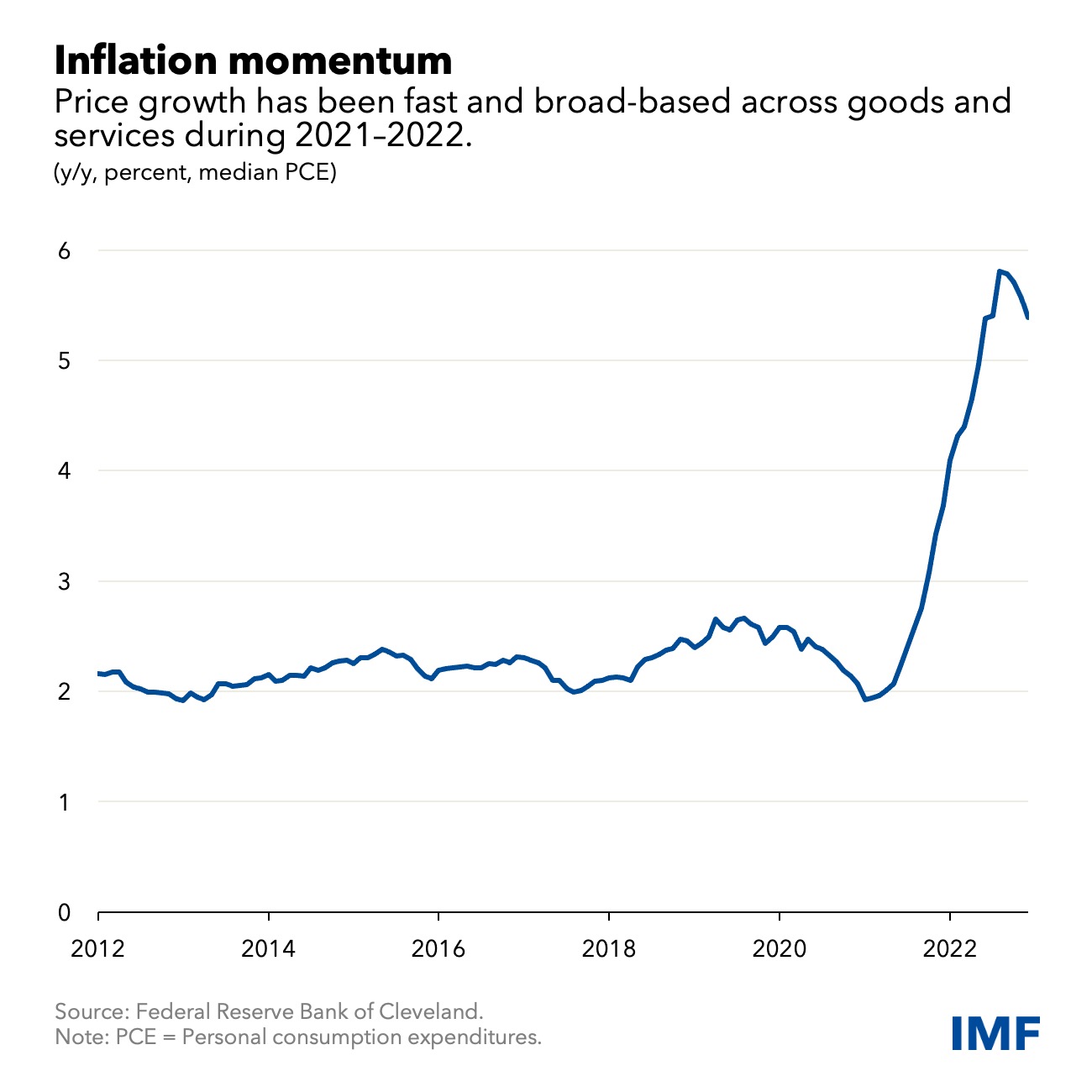

When costs commenced climbing in 2021, they had been originally limited to items influenced by pandemic-relevant disruptions, this kind of as motor vehicles. However, by early 2022, growing selling prices had unfold to housing and other solutions such as lodges and places to eat. Progress of prices in the individual intake expenditure index is now around 5½ p.c, perfectly over the 2 {515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} target.

A scorching labor marketplace

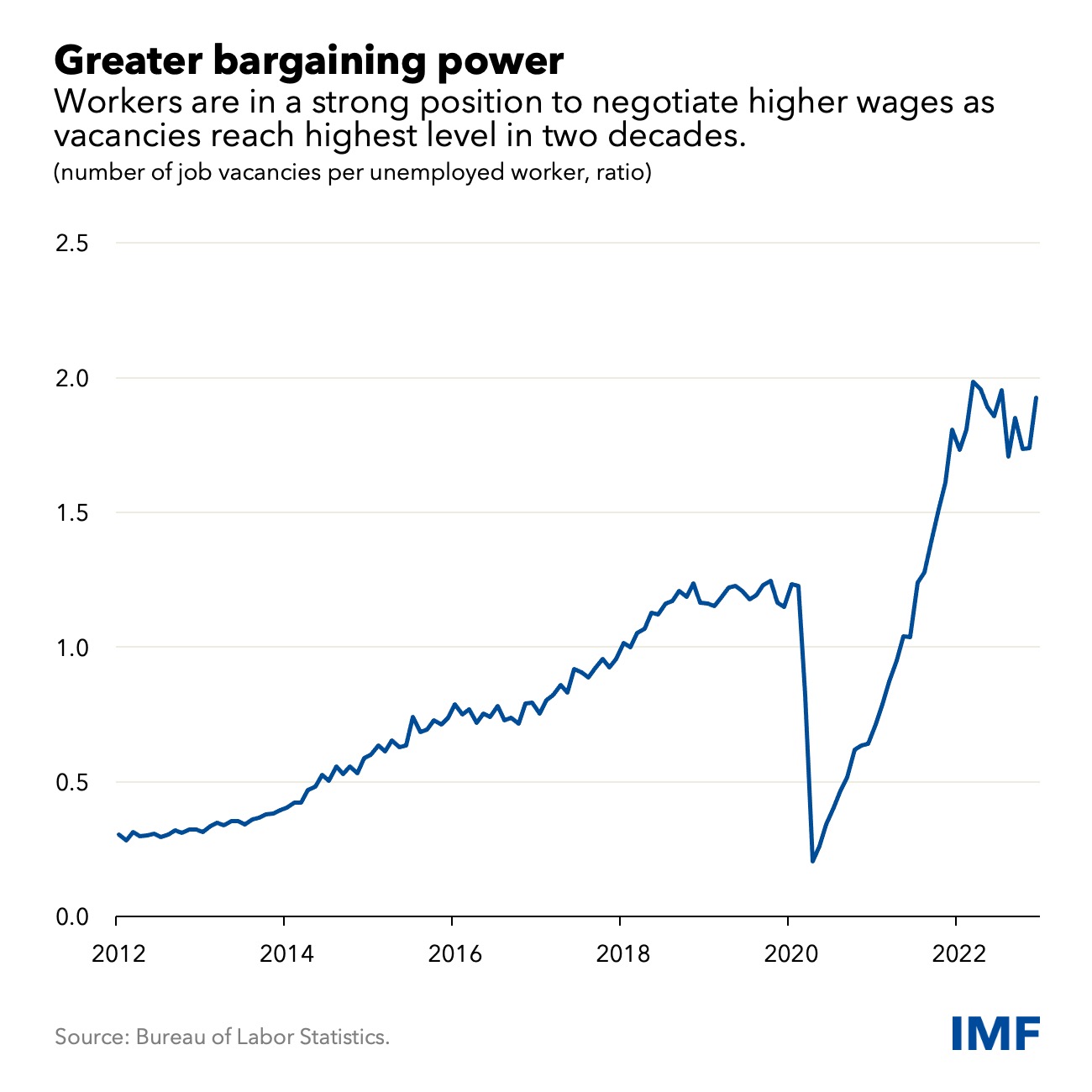

Since mid-2021, as the US overall economy swiftly recovered, the demand for workers has far outstripped the offer. Workers have grow to be extra likely to stop jobs and look for new types, and early retirements have also held down the source of out there staff. These components have in the end increased workers’ bargaining electric power to negotiate pay back raises, contributing to both equally greater wages and selling prices, as corporations improved rates to go over mounting wage charges. This has particularly been the scenario in labor-intense industries, this sort of as inns and dining places.

A balancing act

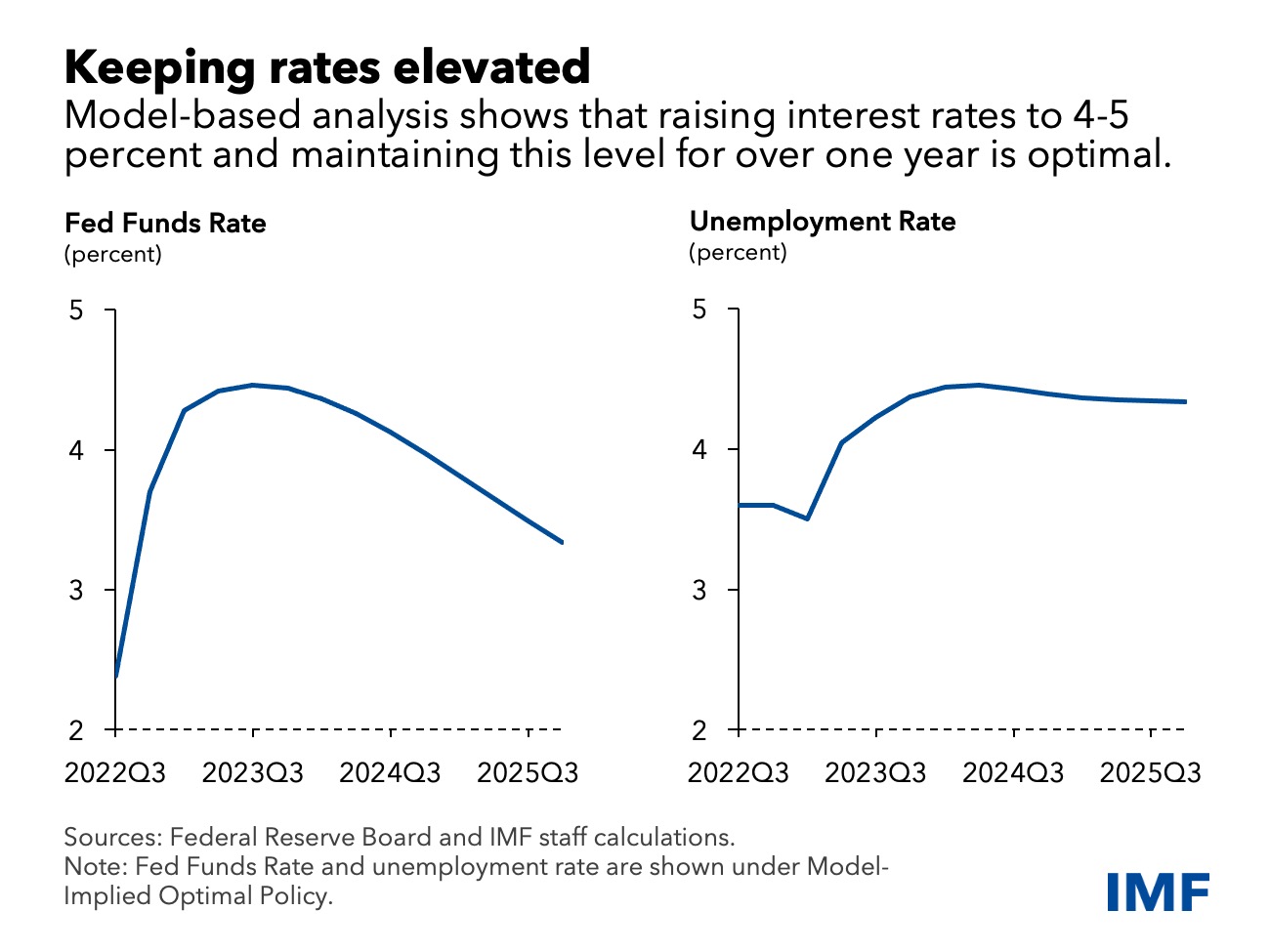

The Fed’s mandate is to realize selling price security and greatest work. To attain these, product-centered evaluation by Fund staff employing the Fed’s FRBUS model shows that the Fed could attain these objectives by raising curiosity rates to a peak of 4-5 {515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}, sustaining that for all-around 1-1½ several years, having into account workers’ potent bargaining place and the high quantity of vacancies per unemployed worker. The increased curiosity prices would weaken the demand from customers for employees and improve unemployment modestly. This would cut down the tension for massive wage and value raises, specifically in the services sector, supporting to reduced inflation.

Where things stand

Most Federal Open Sector Committee associates task further fascination fee hikes, so that the federal money rate would continue being all over 5–5½ per cent at the conclusion of 2023. There are encouraging signals that the Fed’s policy moves are possessing the supposed effect. Inflation slowed in the previous quarter of 2022 (relative to the summer time), pushed by declining products price ranges. Nonetheless, inflation in solutions costs continues to be elevated and will likely only slide after wage advancement slows.

Bringing inflation down to the Fed’s 2 percent focus on is very important for stable job development and sustainable boosts in incomes about the medium to extensive-operate, and it will offset the cost of temporarily increased unemployment.

****

Andrew Hodge is a Senior Economist in the IMF’s Western Hemisphere Office.