December Jobs Report Offers Good News: Easing Wage Pressures, Healthy Economy

There wasn’t much in the way of reassuring news for investors and the Federal Reserve in 2022. But 2023 is starting off on a better foot with the December jobs report.

The latest reading on the jobs market showed an easing of wage pressures since November, which had sparked renewed inflation concerns. At the same time, job growth has moderated from last year’s elevated pace, and yet remained healthy. That dynamic threads the needle of showing some impact on the economy from the Fed’s efforts to slow the economy and fight inflation through interest-rate increases and, at the same, offering no signs of a more significant slowdown that would reflect an economy tipping into recession.

“Today’s report showed that excess labor demand may be diminishing, helping to slow wage growth and ultimately slow inflation,” says chief U.S. economist at Morningstar Preston Caldwell. “Nevertheless, the report also showed continued robust growth in jobs.” Caldwell says the report won’t shift the Fed’s decision-making in a major way, and job growth is still far above recessionary levels.

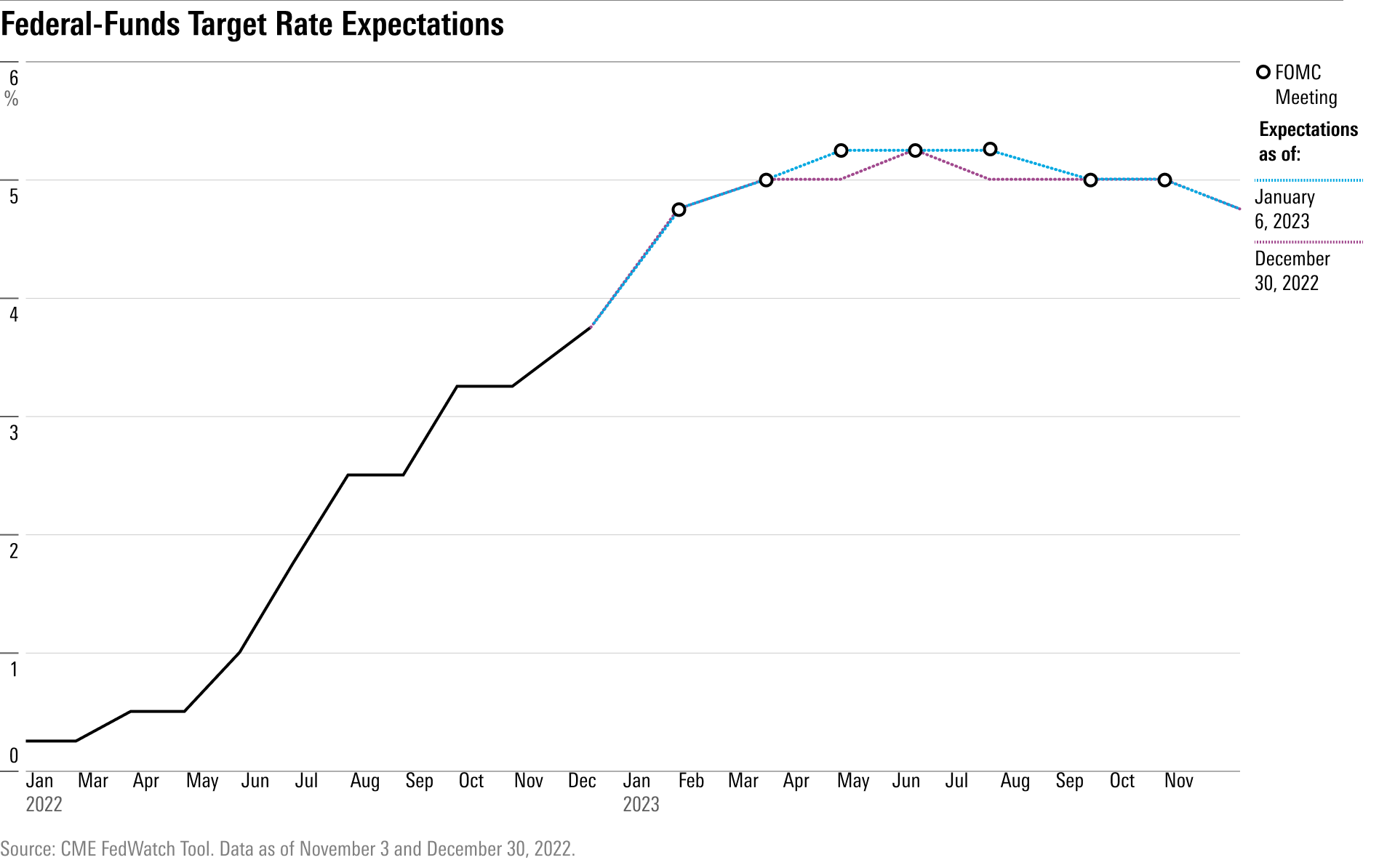

The bond futures market suggests the Fed is expected to raise the federal-funds rate by 0.25 percentage points when officials next meet at the beginning of February. That would be the first time since last March that the Fed raised rates by just a quarter point, having engineered multiple half-point and three-quarters of a point hikes since then.

Attention will now turn to the upcoming December Consumer Price Index report due out next Thursday for confirmation of hopes that inflation pressures are continuing to ease.

Puzzlingly Strong Job Growth

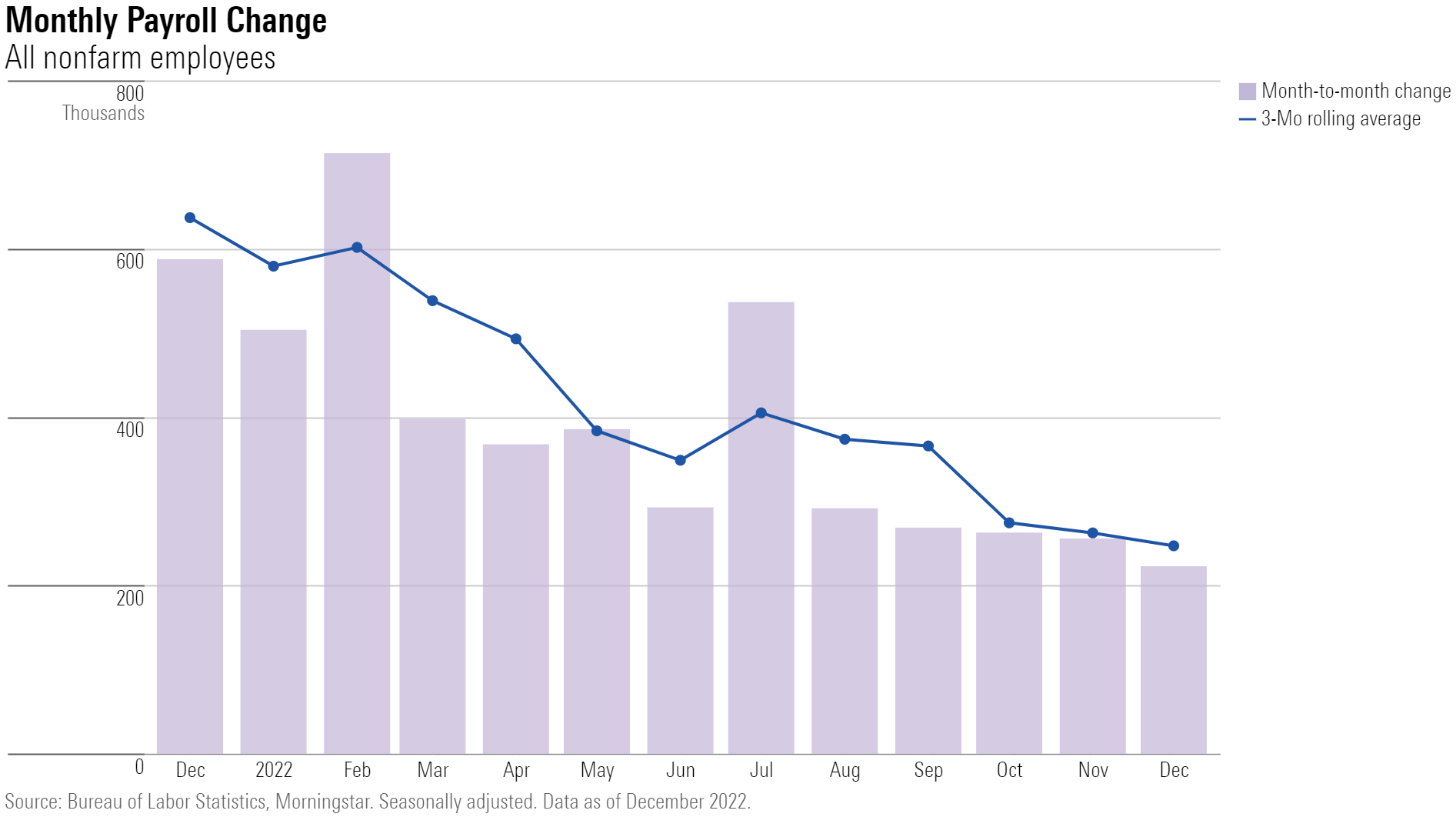

The December jobs report from the Bureau of Labor Statistics showed total nonfarm payrolls rose by 223,000, roughly in line with consensus expectations of 210,000. Job gains were led by leisure and hospitality, healthcare, construction, and social assistance.

With the December gains in hiring, 2022 clocked in as the second-best job creation year in history after 2021.

“Job growth has continued its gradual downtrend, but it’s still puzzlingly strong compared to growth in economic activity,” Caldwell says.

Nonfarm employment rose 3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in December from year-ago levels, according to Caldwell. His forecasts show that real domestic product growth in the fourth quarter is likely to post an increase of around 0.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}-1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} year-over-year. “In ordinary times, we would expect employment growth to track about 1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} lower than real GDP growth.”

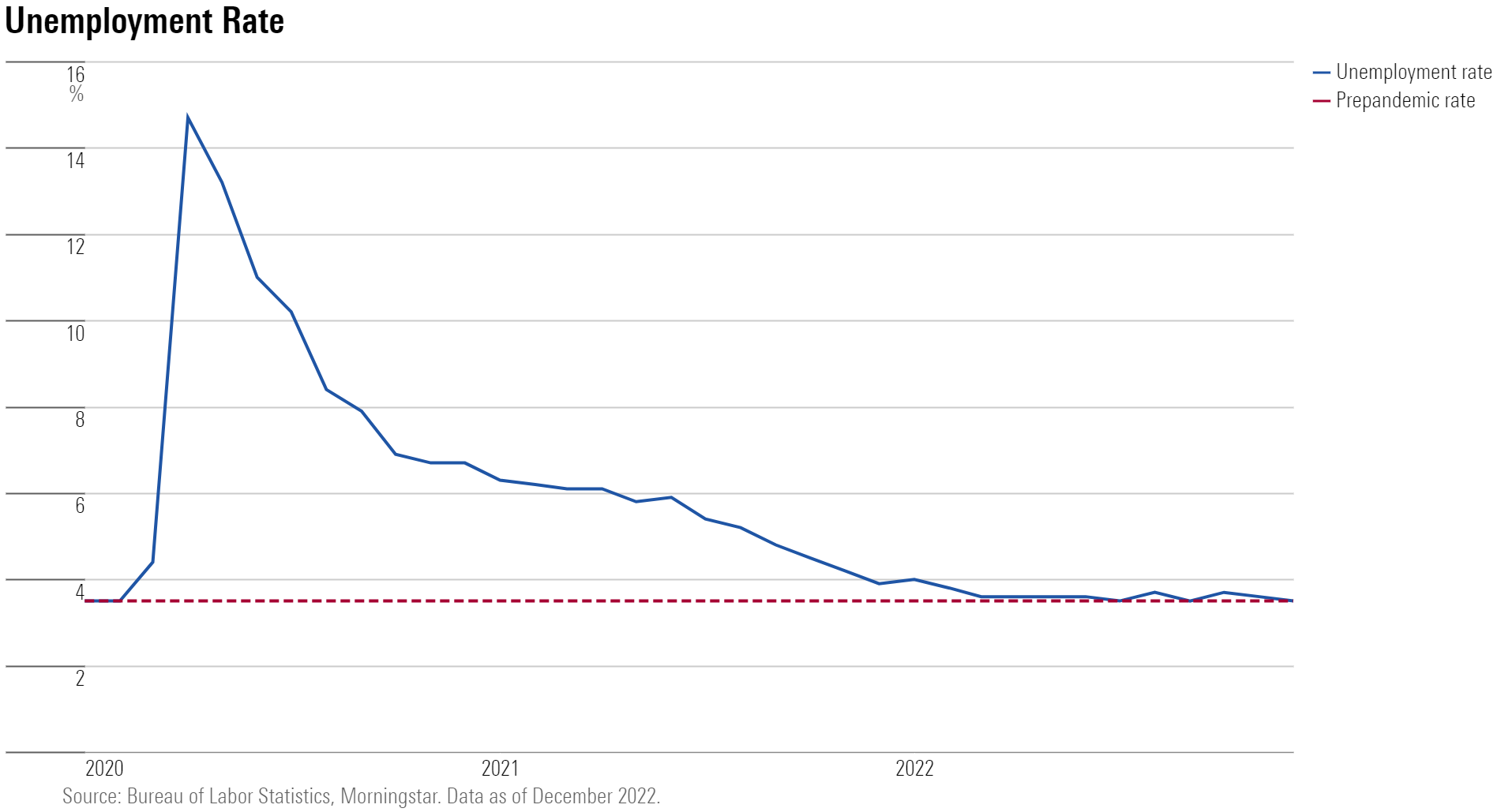

Lowest Unemployment Rate in 50 Years

The unemployment rate edged down to 3.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in December, the Labor Department reported, down from a revised 3.6{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in November. The unemployment rate has held between 3.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} and 3.7{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} since March, but with December’s reading, the unemployment rate statistically matched its lowest since 1969.

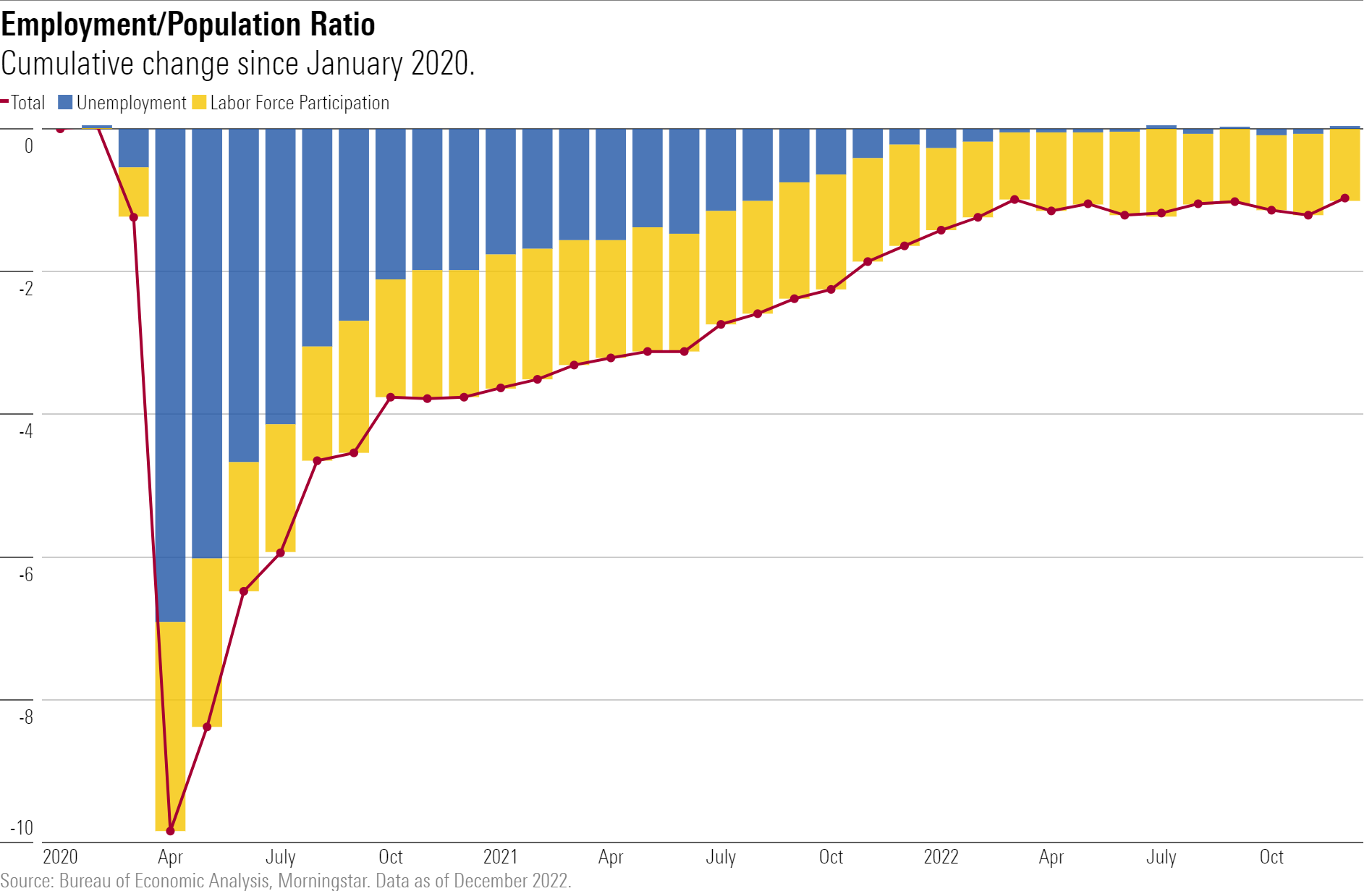

One area within the jobs report that economists have been focusing on has been the overall size of the labor market. Among the many unexpected patterns in the economy in the wake of the pandemic is the large number of workers who never returned to the job market after losing jobs, or quitting, when COVID-19 hit.

The employment/population ratio increased by 0.2 percentage points over the month to 60.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. The labor force participation rate held steady at 62.3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

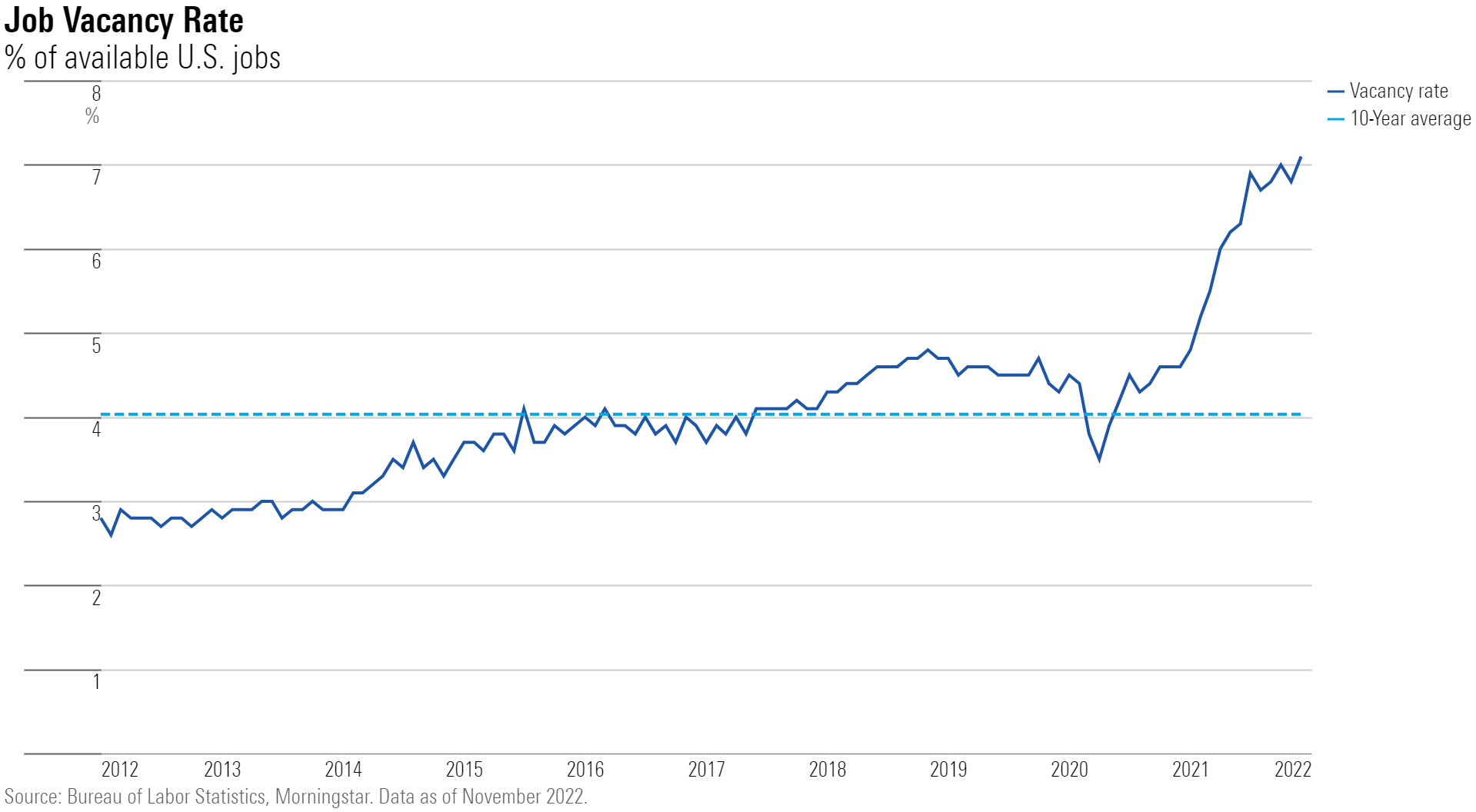

“Job openings remain sky high at 6.4{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in November, compared to 4.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} prior to the pandemic,” Caldwell says. “However, employers don’t appear willing to fill these openings at any cost, limiting the impact of openings on wage inflation.”

Some Signs of Cooling

Caldwell does see signs that labor demand is cooling. Employment in the “temporary help services” industry has declined 3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in the last three months. “This category is a leading indicator because employers tend to hire or layoff temporary employees prior to doing so with permanent ones.”

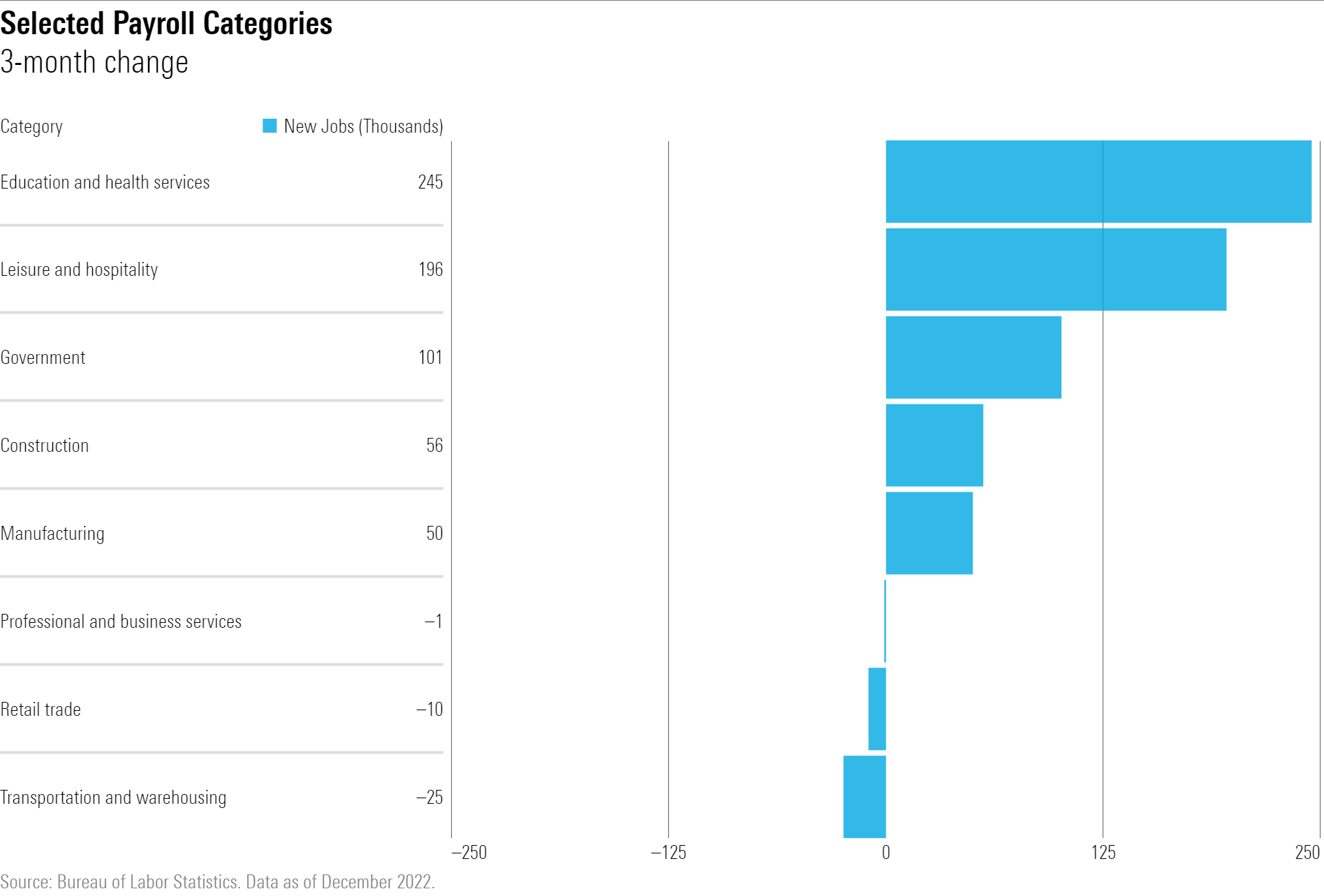

Among other job categories, hiring was led by employment in leisure and hospitality, which rose by 67,000 in December. Healthcare employment increased by 55,000, and employment in construction increased by 28,000 in December, as specialty trade contractors added 17,000 jobs.

The Labor Department noted that construction employment increased by an average of 19,000 per month in 2022, little different than the average of 16,000 per month recorded in 2021.

“It’s surprising to still see growth in construction jobs, given the slowdown in the housing market from higher interest rates.” Caldwell says that this is one indicator that the impact of Fed tightening in 2022 has yet to play out in terms of the job market.

At the same time, job losses are materializing in some industries, such as retail trade and transportation and warehousing, he says.

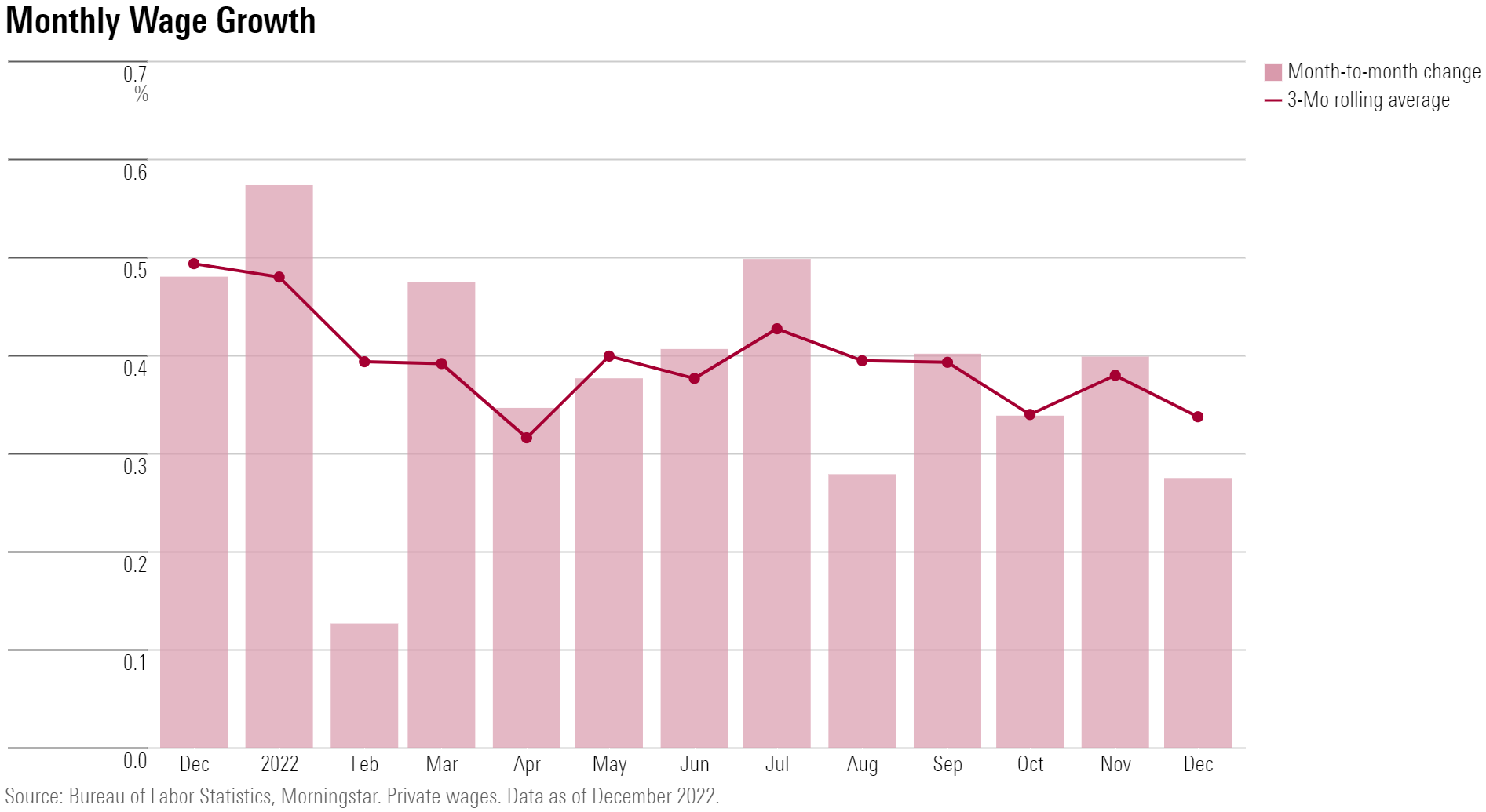

Wage Pressures Ease

Subsiding wage growth also shows a job market that is returning to normal after the excesses of the past two years. Private wage growth averaged just a 4.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} annual rate in the last three months thanks to downward revisions to prior months’ data. “This is a fairly benign rate of wage growth—roughly consistent with the Fed’s inflation target.” Before the revisions, wage growth appeared to be growing at a 5.8{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} annual rate.

December’s report showed wage gains moderated slightly, up 0.27{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from month-ago levels. In November, wage gains had gone up 0.40{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

Fed Rate Outlook Unchanged by Jobs Report

“Today’s report doesn’t shift the Fed’s decision-making in a major way,” Caldwell says. That lower wage growth should provide comfort for the Fed in its battle against inflation, he says.

At the same time, there remains a lack of clarity from the data. “Wage growth data has been noisy recently—and subject to large revisions, which diminishes confidence in the signal provided from this data.”

Job growth is still far above recessionary levels, Caldwell says, “so there’s no alarm signal for the Fed to cease hiking interest rates for now.”

After the report’s release, expectations for a 0.25-percentage-point increase in the federal-funds rate at the February Fed meeting rose. According to the CME FedWatch Tool, a quarter-point increase in the funds rate target from 4.25{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}-4.50{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} is given a 77{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} chance, while a 0.50-percentage-point hike is seen as having 23{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} odds. A month ago, most expected the Fed to raise rates by the more aggressive half a percentage point amount.

Expectations for where the federal-funds rate will be months down the road also rose following the release of the report. The majority of market participants now see the federal-funds effective rate reaching 5.25{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} at the May meeting. A month ago, most expected that the rate wouldn’t reach 5.25{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} until later in the summer.