Electrifying The Automotive Industry: The Rise Of QuantumScape (NYSE:QS)

PhonlamaiPhoto/iStock by way of Getty Pictures

QuantumScape (NYSE:QS) is a company at the forefront of the shift from common combustion engines to cutting-edge battery-electrical powertrains. The sector for battery-electric powered motor vehicles is growing speedily, and QuantumScape is poised to direct the demand with its innovative anode-free lithium-metal technologies. This engineering features pros more than conventional lithium-ion batteries, together with larger power density, quicker charging speeds, and the capacity to maximize the number of layers while preserving performance. The organization is performing tirelessly to provide its QS- production line to complete industrial potential.

The firm believes it stands by itself with its pioneer good-point out separator for lithium-metallic batteries. This separator, which is created of a dense, versatile ceramic content, stops dendrite formation at large electrical power densities, producing it perfect for automotive use and fast charging. Compared with regular porous separators, this separator permits trustworthy cycling of lithium-metallic batteries and delivers better volumetric electrical power density by reducing anode host resources. The firm’s single-layer solid-state cells have been rigorously tested and boast spectacular capabilities, together with the means to charge from 10{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} to 80{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} potential in beneath 15 minutes, a lot quicker than the levels of competition, all although running at a broad array of temperatures and retaining its longevity.

QuantumScape critical technology elements

QuantumScape is self-confident that its engineering will revolutionize the electric powered car market. The business aims to get rid of the hindrances of current EV technological know-how, this sort of as gradual charging and quick battery lifestyle, enabling EVs to much better contend with traditional fossil fuel motor vehicles.

QuantumScape’s battery technological know-how is engineered to handle the five vital specifications for prevalent adoption of electric autos. The technological innovation features greater power density, prolonged battery existence, a lot quicker charging speeds, increased safety, and value-performance. The strong-state battery cells will considerably expand the array of EVs while maintaining the measurement and excess weight of the battery pack unchanged.

The company has developed a match-shifting engineering that not only maximizes the battery life by curbing the reduction of lithium in traditional lithium-ion batteries, but also revolutionizes the charging process with its skill to charge from 10{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} to 80{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} potential in a mere 15 minutes – far faster than traditional batteries. To best it off, this engineering employs a ceramic separator, providing not only increased protection, but peace of mind as well, as it is non-combustible as opposed to conventional polymer separators. And finally, the technological know-how has the additional bonus of removing the need for anode host material, primary to a reduction in producing charges and larger efficiency as opposed to regular lithium-ion batteries.

QuantumScape Competitive strengths

The company has shown its technical prowess by setting up and tests over 100,000 one-layer stable-state cells, effectively assembly the necessities of the automotive market. Volkswagen, a popular world-wide automaker, has been a collaboration associate and investor since 2012, with a full financial investment of above $300 million in the organization. Moreover, the corporation has established a partnership with a 2nd best ten automotive unique equipment producer, even further cementing its existence in the market.

They have a solid patent and mental property portfolio, with over 250 U.S. and foreign patents and patent programs. The organization has a selection of patents masking composition of matter, enabling battery technologies, manufacturing technological innovation, and content proportions. The enterprise has invested over $350 million and 10 many years of development.

Scaling-up

The administration crew is focused to the expansion of its cutting-edge battery technology, with the goal of commercially developing it by 2025. To obtain this, they proceed to get the job done in the direction of developing multi-layer cells with the proportions wanted for business use. Their system involves optimizing all parts of the mobile for mass output and decreasing expenditures by developing and validating economical producing processes. They also intention to increase the yield of their separators, resulting in a lot less squander and better utilization of their sources. A lengthy-time period lease has been secured for their facility, QS-, which is established to develop cells by 2023 and present ability for progress do the job and hundreds of extensive-assortment battery electrical test motor vehicles yearly.

QuantumScape has formed a joint undertaking, QSV Functions LLC, with Volkswagen to fulfill the automaker’s battery demands. The joint venture’s first facility, QS-1, will be the premier production centre for the firm’s slicing-edge battery technology, specifically for automotive programs. The business intends to develop its production potential with Volkswagen to fulfill the increasing demand from customers. On top of that, the firm is dedicated to working closely with other initial equipment producers to be certain common availability of their strong-point out battery cells in the long run.

There is possible for its good-state battery technologies in other significant markets this sort of as stationary storage and purchaser electronics. The adaptable layout of the technology enables for different business enterprise designs.

Financials

The organization is generating strides towards its 24-layer A-sample battery mobile structure, a key milestone. A past contamination challenge was decreased by means of root trigger identification and other procedure improvements. These problems have enormous impact in a corporation at this stage.

In Q3 2022, the firm expended $121 million in functioning expenditures and experienced a web loss of $118 million. The hard cash operating fees had been $79 million for the quarter and the enterprise has a funds functioning cost direction of $225 million to $275 million for the total year 2022. The funds expenditures in Q3 have been $54 million and primarily directed in direction of facility investments and devices. The firm put in $110 million on operations and CapEx in Q3 and now expects to enter 2023 with more than $1 billion in liquidity, higher than its past guidance of around $950 million. The corporation is focusing on maximizing capital performance in its QS- pre-pilot line and is concentrating on calendar year-end delivery of equipment desired for early generation.

Valuation & Dangers

QuantumScape faces a selection of hazards in its efforts to build and commercialize solid-condition batteries. These threats involve troubles in producing a superior-quantity, price tag-powerful and reliable battery cell, delays and value overruns in the manufacturing system, troubles in setting up supply interactions and a dependence on a partnership with Volkswagen. The enterprise also faces the threat of battery general performance failure and the have to have to catch the attention of shoppers for industrial creation. Managing fees and safeguarding mental home rights, as well as defending from legal worries, are also risks. The battery industry is extremely aggressive, and the company may well not be able to compete properly.

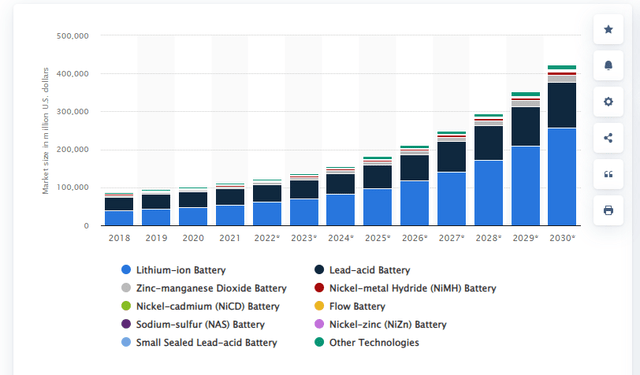

QuantumScape’s absence of revenue tends to make it hard to establish its price by way of regular approaches. Having said that, a single can assess the potential by analyzing the sizing of the full addressable sector for Lithium batteries, which is estimated to reach $257 billion by the stop of the decade, according to Statista.

Statista

Panasonic, with Tesla (TSLA) as its main customer, currently retains a sector share in the vicinity of 9{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. With Volkswagen as a spouse, QuantumScape has a acceptable possibility of capturing at minimum 5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} of the market share by the end of the 10 years, ensuing in a opportunity profits of $12.85 billion. If we use a array of 1 to 2 situations sales for valuation, we arrive at a attainable price in between $12.85 billion and $25.7 billion. These figures are noteworthy and merit trying to keep an eye on the organization. In the subsequent pair of decades, there might be prospects to possibly validate or refute this thesis and make a transfer.

On the other hand, it is really vital to retain in head that investing in QuantumScape entails significant risks. The corporation is in the course of action of ramping up output in 2023 and 2024 and has nevertheless to crank out earnings. These decades will probably be crucial and hugely unpredictable for the inventory. Creation worries are to be expected and will probable result in apparent fluctuations in the inventory. Sharp setbacks and sudden recoveries will result in the inventory price to fluctuate considerably.

It may appear to be sensible to stay clear of the stock till there is bigger visibility. Having said that, by the time the scenario will become clear, the market might have previously acted on it, leaving minimal area for substantial gains. In my view, a greater method would be to carefully check the ramp-up development and often reevaluate the technological strengths of QuantumScape’s option. If our investigation confirms the scalability of the know-how, any damaging news can be utilized as an prospect to commit in the inventory.