Goldman Sachs Says These 2 Automotive LiDAR Stocks Should Be On Your Radar; Sees at Least 90{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} Upside Potential

While electric powered motor vehicles (EVs) are obtaining the headlines in the automotive industry, there are two other tendencies that will reward nearer trader notice. These are driver guidance and autonomous motor vehicles. These are based on equivalent technologies – state-of-the-art sensor techniques, device discovering and AI, and interactive interfaces for the human operator – but they fill distinctive roles. For buyers, even so, these systems will offer a realm of chances the place the rubber fulfills the street.

The vehicle market authorities from expenditure firm Goldman Sachs have been proper on major of these new developments in the automotive world, and have been specifically enthusiastic about LiDAR devices. These are substantial-tech sensor programs (the time period is derived from ‘light detection and ranging’) using lasers to supply the maximum possible precision in range and velocity facts about surrounding objects. LiDAR signifies the most current in sensing tech, and Goldman analyst Allen Chang writes of it, “We feel we are in the early phases of LiDAR mass adoption and design worldwide assisted driving penetration to rise 3-fold in excess of the subsequent 10 decades. This represents among the speediest expansion profiles in the EV source chain over the next ten years.”

We can abide by the Goldman Sachs lead and use the TipRanks system to pull up the particulars on two of the firm’s LiDAR picks, organizations that the G-S analysts see at the forefront of the LiDAR revolution. Every single of these focus on providers has a Powerful Get combination ranking from the Wall Road analysts, and Goldman sees them with at least 80{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} upside for the coming 12 months. Let us take a search at their facts, as wells as the Goldman commentaries.

Hesai Team (HSAI)

We’ll start with Shanghai-based mostly Hesai Team, a international leader in the enhancement and software of LiDAR devices. The company’s sensor tech has identified employs in autonomous mobility, of program, but also in the trucking marketplace, robotics, and even manufacturing facility creation. As of December 31, 2022, Hesai Group had transported out above 100,000 LiDAR models, and the enterprise has also crafted up powerful connections with top OEMs in the motor vehicle industry, and has a 60{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} industry share in the autonomous mobility – self-driving motor vehicle – specialized niche.

Hesai Group only not long ago joined the U.S. community markets, owning carried out an initial public supplying of American Depositary Shares (Ads). The IPO, which closed on February 13, saw the enterprise put 10 million ADSs on the market at an opening rate of $19 each and every and raise $190 million in gross proceeds. The IPO was the biggest first giving of a Chinese inventory on the US markets since 2021.

Very last week, just above a month from the IPO, Hesai introduced its initially quarterly financial final results as a publicly traded entity on the US NASDAQ exchange. The report, for 4Q22, showed a quarterly major line of $59.3 million, for a 56{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} 12 months-about-yr increase. This was supported by a substantial 739{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} y/y boost in quarterly LiDAR deliveries which strike 47,515. Of that total, 43,351 have been ADAS (superior driver aid programs) and 4,164 were autonomous mobility. Inspite of these successes, Hesai’s stock has experienced in the market place downturn and is down 42{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} considering that buying and selling commenced.

Goldman’s Allen Chang, having said that, sees plenty of rationale to back again Hesai. Explaining his bullish stance, he writes, “We spotlight Hesai’s three crucial aggressive strengths: (1) Technological innovation – Hesai pursues a distinctive “ASIC” engineering that integrates critical factors to reduce electrical power consumption, simplify producing and decreased unit price (2) Manufacturing – Hesai owns a entire world-class LiDAR production facility in Shanghai. Their producing and item style and design fortify every single other, allowing for more quickly product iteration. (3) Huge domestic market place – China sales opportunities ADAS and autonomous adoption, with penetration in new car or truck income to expand 10X from 8{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} to 84{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} (2021-30E). This expansion delivers the option for Hesai to scale up its technologies.”

Getting this ahead, Chang sees suit to level the shares as a Buy, with a $29 price tag target that indicates a strong 123{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} upside probable for the coming calendar year. (To watch Chang’s observe document, click on below.)

In its brief time on the US public marketplaces, Hesai has picked up 3 analyst tips – and they are all constructive, for a unanimous Robust Obtain consensus ranking. The stock has a current trading selling price of $13.00, and its $28.50 normal price target indicates a 12-month achieve of 119{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. (See Hesai’s stock forecast at TipRanks.)

Innoviz Systems (INVZ)

Future on our list is Innoviz Technologies, an additional chief in the planet-vast LiDAR market. Innoviz both of those models and manufactures superior-conclude solid-point out LiDAR sensors, alongside with the application needed to link the sensor hardware with the controlling computer techniques. Innoviz has been working with numerous huge-identify automotive corporations, together with BMW and Volkswagen.

Innoviz shares showed a peak in February of this yr, and are down 33{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from that level more than the previous two yrs, the inventory has fallen 65{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. Through this time, the company has been jogging net losses, and revenues have unsuccessful to choose off. A look at the company’s last economic report reveals that the total 12 months 2022 quantities are modestly greater yr-above-yr, that the 4Q22 missed anticipations, and the ahead assistance upset.

At the quarterly degree, the firm confirmed revenues of $1.58 million, missing the estimates and down just about 5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} yr-in excess of-year. The company’s Q4 EPS, a 25-cent decline, arrived in under the 24-cent loss forecast. In the comprehensive 12 months quantities, the prime line did grow 10{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} to 6 million, and the enterprise sold a history range of LiDAR units.

Additional souring sentiment, Innoviz missed on the ahead revenue steerage. The corporation projected whole 2023 revenues in a assortment amongst $12 million and $15 million when this would characterize a doubling – or far more – of the leading line y/y, the analyst consensus had anticipated guidance of ~$30 million.

This stock is protected for Goldman by 5-star analyst Mark Delaney, who acknowledges the headwinds that the corporation is going through but goes on to define an upbeat prospect: “We feel the 4Q report was an incremental destructive, even though we keep our Get score on the inventory reflecting our positive watch of the company’s prolonged-time period chance. Exclusively, we feel that the company’s purchase reserve remains potent which include style wins at 3 automobile OEMs (i.e. BMW, VW, and an Asian centered OEM). Though the output ramp up is happening more slowly but surely than we’d envisioned with 2023 income steering below the Avenue, we feel that as OEM ADAS courses ramp in the coming decades that the business will see improved effects.”

Quantifying his stance, Delaney costs INVZ shares as a Get, and his value focus on, established at $7, signifies his self-confidence in an upside of 91{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} for 2023. (To observe Delaney’s track record, click on right here.)

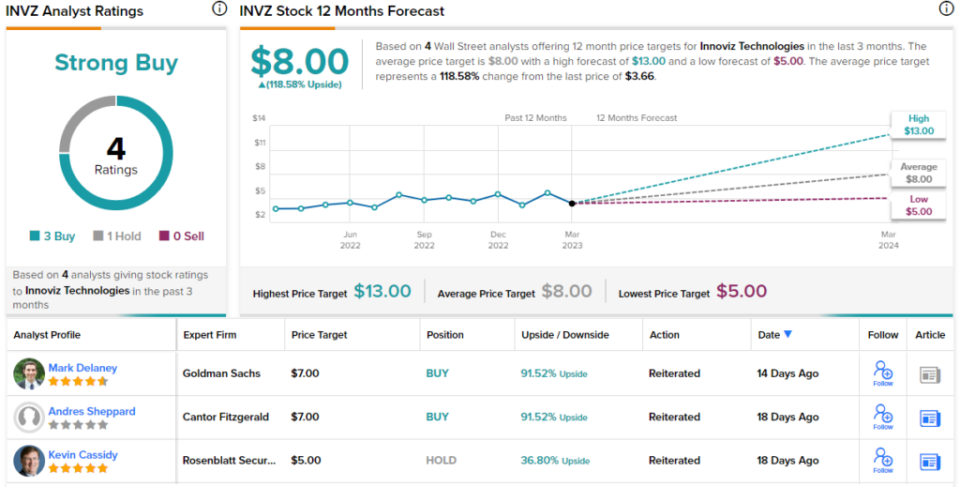

Over-all, Innoviz has a Powerful Obtain consensus rating from the Street, based on 4 analyst opinions with a 3 to 1 breakdown favoring Buy about Hold. The stock has an $8 typical price tag concentrate on, higher than the Goldman outlook and suggesting a 118{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} upside from the trading rate of $3.66. (See Innoviz’s stock forecast at TipRanks.)

To discover excellent strategies for stocks buying and selling at interesting valuations, pay a visit to TipRanks’ Finest Shares to Purchase, a freshly released software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this short article are solely those of the highlighted analysts. The material is meant to be utilised for informational reasons only. It is really critical to do your own assessment before generating any investment decision.