Here is What to Know Beyond Why Rivian Automotive, Inc. (RIVN) is a Trending Stock

Rivian Automotive (RIVN) has lately been on Zacks.com’s record of the most searched shares. Therefore, you may possibly want to think about some of the crucial factors that could impact the stock’s efficiency in the in close proximity to long term.

Shares of this a producer of motor automobiles and passenger cars and trucks have returned -26.7{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} more than the earlier month as opposed to the Zacks S&P 500 composite’s no transform. The Zacks Automotive – Domestic business, to which Rivian Automotive belongs, has dropped 21.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} over this period. Now the crucial query is: In which could the stock be headed in the near term?

Even though media reports or rumors about a considerable improve in a firm’s business prospective buyers usually cause its stock to development and lead to an quick cost change, there are generally selected essential elements that eventually generate the invest in-and-keep final decision.

Earnings Estimate Revisions

Alternatively than focusing on everything else, we at Zacks prioritize analyzing the alter in a firm’s earnings projection. This is due to the fact we feel the fair price for its inventory is determined by the present price of its foreseeable future stream of earnings.

Our examination is in essence primarily based on how offer-aspect analysts masking the stock are revising their earnings estimates to take the latest business traits into account. When earnings estimates for a business go up, the honest value for its stock goes up as properly. And when a stock’s reasonable worth is better than its current industry rate, traders tend to invest in the stock, resulting in its rate transferring upward. Due to the fact of this, empirical experiments suggest a strong correlation amongst trends in earnings estimate revisions and brief-phrase inventory value movements.

For the present-day quarter, Rivian Automotive is envisioned to submit a loss of $1.88 per share, indicating a improve of +22.6{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from the 12 months-in the past quarter. The Zacks Consensus Estimate has improved +.5{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} about the final 30 times.

The consensus earnings estimate of -$6.50 for the current fiscal calendar year suggests a calendar year-above-yr change of +56{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. This estimate has altered +.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} over the previous 30 times.

For the up coming fiscal calendar year, the consensus earnings estimate of -$4.93 indicates a transform of +24.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from what Rivian Automotive is expected to report a 12 months in the past. In excess of the past month, the estimate has changed -.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

Possessing a sturdy externally audited observe record, our proprietary inventory rating resource, the Zacks Rank, features a a lot more conclusive photograph of a stock’s cost way in the around term, considering that it properly harnesses the ability of earnings estimate revisions. Due to the sizing of the modern change in the consensus estimate, together with three other variables connected to earnings estimates, Rivian Automotive is rated Zacks Rank #3 (Hold).

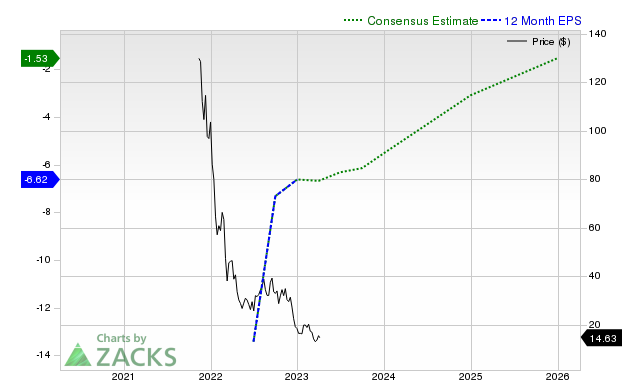

The chart down below reveals the evolution of the company’s ahead 12-thirty day period consensus EPS estimate:

12 Month EPS

Income Growth Forecast

Though earnings development is arguably the most excellent indicator of a firm’s monetary overall health, absolutely nothing comes about as this kind of if a business isn’t really capable to develop its revenues. Following all, it’s just about impossible for a company to raise its earnings for an extended period without expanding its revenues. So, it truly is critical to know a company’s likely revenue development.

For Rivian Automotive, the consensus profits estimate for the recent quarter of $768.28 million signifies a calendar year-in excess of-yr transform of +1322.7{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. For the present and following fiscal several years, $1.77 billion and $5.34 billion estimates indicate +3111.2{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} and +202.1{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} adjustments, respectively.

Previous Noted Results and Shock History

Rivian Automotive described revenues of $536 million in the last documented quarter, symbolizing a 12 months-more than-year alter of +53500{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. EPS of -$1.57 for the exact same period compares with -$7.68 a 12 months ago.

When compared to the Zacks Consensus Estimate of $513.89 million, the claimed revenues characterize a shock of +4.3{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. The EPS shock was +11.8{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}.

Around the previous 4 quarters, Rivian Automotive surpassed consensus EPS estimates two occasions. The business topped consensus earnings estimates a few periods over this interval.

Valuation

Without taking into consideration a stock’s valuation, no financial investment decision can be efficient. In predicting a stock’s potential value general performance, it is crucial to determine irrespective of whether its present-day cost properly demonstrates the intrinsic value of the underlying business and the company’s advancement prospects.

Comparing the current worth of a firm’s valuation multiples, this sort of as its price-to-earnings (P/E), rate-to-product sales (P/S), and price tag-to-hard cash flow (P/CF), to its possess historic values will help ascertain no matter whether its inventory is reasonably valued, overvalued, or undervalued, whereas evaluating the enterprise relative to its peers on these parameters provides a excellent perception of how sensible its inventory rate is.

As section of the Zacks Model Scores method, the Zacks Worth Design and style Score (which evaluates both of those common and unconventional valuation metrics) organizes stocks into 5 groups ranging from A to F (A is superior than B B is better than C and so on), making it useful in identifying whether or not a stock is overvalued, rightly valued, or briefly undervalued.

Rivian Automotive is graded F on this entrance, indicating that it is buying and selling at a premium to its friends. Click in this article to see the values of some of the valuation metrics that have driven this quality.

Conclusion

The specifics mentioned listed here and much other facts on Zacks.com could enable decide regardless of whether or not it truly is worthwhile paying out notice to the market place buzz about Rivian Automotive. On the other hand, its Zacks Rank #3 does advise that it may well perform in line with the broader industry in the around phrase.

Want the newest recommendations from Zacks Financial commitment Exploration? Nowadays, you can download 7 Best Shares for the Future 30 Days. Click to get this free of charge report

Rivian Automotive, Inc. (RIVN) : Absolutely free Stock Evaluation Report