Here’s What’s Concerning About NVIDIA’s (NASDAQ:NVDA) Returns On Capital

Obtaining a business that has the prospective to increase significantly is not effortless, but it is probable if we glimpse at a several vital financial metrics. First of all, we’d want to identify a expanding return on capital employed (ROCE) and then alongside that, an ever-expanding foundation of money employed. Set simply, these sorts of enterprises are compounding equipment, that means they are frequently reinvesting their earnings at ever-greater charges of return. On the other hand, after briefly hunting in excess of the figures, we really don’t assume NVIDIA (NASDAQ:NVDA) has the makings of a multi-bagger likely forward, but let us have a search at why that might be.

Knowing Return On Cash Employed (ROCE)

If you haven’t labored with ROCE just before, it measures the ‘return’ (pre-tax financial gain) a enterprise generates from cash utilized in its business enterprise. The formula for this calculation on NVIDIA is:

Return on Cash Employed = Earnings Prior to Desire and Tax (EBIT) ÷ (Full Property – Latest Liabilities)

.16 = US$5.6b ÷ (US$41b – US$6.6b) (Primarily based on the trailing twelve months to January 2023).

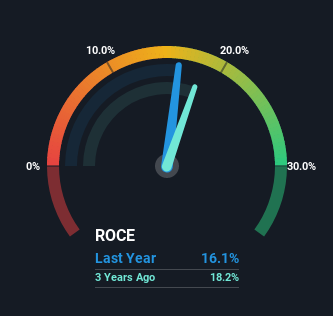

So, NVIDIA has an ROCE of 16{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502}. That is a somewhat typical return on capital, and it can be about the 14{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} generated by the Semiconductor industry.

Watch our latest analysis for NVIDIA

In the over chart we have calculated NVIDIA’s prior ROCE from its prior efficiency, but the long run is arguably additional essential. If you happen to be fascinated, you can look at the analysts predictions in our free report on analyst forecasts for the enterprise.

The Development Of ROCE

On the surface area, the development of ROCE at NVIDIA doesn’t encourage confidence. More than the very last five decades, returns on funds have lowered to 16{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} from 32{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} 5 yrs back. On the other hand it appears like NVIDIA may well be reinvesting for extensive term expansion simply because whilst capital employed has elevated, the firm’s product sales haven’t transformed a lot in the previous 12 months. It is value retaining an eye on the firm’s earnings from in this article on to see if these investments do finish up contributing to the base line.

The Bottom Line

Bringing it all alongside one another, though we are relatively encouraged by NVIDIA’s reinvestment in its possess small business, we’re informed that returns are shrinking. But to long phrase shareholders the inventory has gifted them an unbelievable 372{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} return in the last 5 many years, so the marketplace appears to be rosy about its future. On the other hand, unless these underlying tendencies turn a lot more beneficial, we would not get our hopes up too superior.

If you want to carry on researching NVIDIA, you may well be interested to know about the 3 warning signs that our evaluation has uncovered.

If you want to research for sound providers with great earnings, check out this free list of firms with fantastic balance sheets and impressive returns on fairness.

Have comments on this posting? Involved about the content material? Get in contact with us specifically. Alternatively, email editorial-team (at) simplywallst.com.

This report by Basically Wall St is normal in mother nature. We present commentary based mostly on historical data and analyst forecasts only utilizing an impartial methodology and our articles are not meant to be fiscal advice. It does not constitute a recommendation to get or market any inventory, and does not get account of your goals, or your money scenario. We aim to carry you extended-phrase targeted evaluation pushed by fundamental data. Take note that our evaluation might not component in the most recent cost-delicate firm announcements or qualitative materials. Only Wall St has no posture in any shares outlined.

Be part of A Compensated Consumer Study Session

You’ll acquire a US$30 Amazon Gift card for 1 hour of your time while helping us establish better investing applications for the specific traders like you. Sign up listed here