Russia’s war economy isn’t as resilient as reports would have you believe

Happy Friday, team. I’m Phil Rosen. This 7 days we’ve observed a storm of economic data in the US.

The alphabet soup of readings — CPI, PPI, and jobless statements — all place to cooling inflation and a softening labor current market.

In theory, that’s excellent news for the Fed, mainly because it suggests its coverage is doing work.

Must the central lender decide to make one last amount hike in Might, it could be like a greenlight for bulls.

The S&P 500 surged 35{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} immediately after the final rate hike in 1995, and 28{515baef3fee8ea94d67a98a2b336e0215adf67d225b0e21a4f5c9b13e8fbd502} in the yr soon after the 2018 cycle’s previous go.

But don’t just take those figures in a vacuum — shares were damaging in the 1960s the yr immediately after the Fed’s remaining policy adjustment in that cycle. Other several years, like 1981 and 2000, observed downturns too.

Possibly way, it is really almost certainly finest to keep nimble, considering that any one can slice up facts to tell a story.

That provides us to today’s primary tale — economists say the formal data coming out of Russia is just not painting an correct photo of Putin’s wartime economy.

If this was forwarded to you, indicator up here. Obtain Insider’s app here.

1. Russia’s economy is worse than Moscow claims, and significantly of that stems from juiced-up army investing covering up just how considerably the private sector is shrinking.

The Kremlin’s official GDP figures don’t particularly tell the entire tale, and there is explanation to be careful of believing the quantities, according to a report published for the Heart for Economic Plan Study.

The two authors set up a handful of choice indicators that increase substantially wanted context to the govt knowledge.

“This is visible in our alternate tracker of domestic financial activity: retail gross sales have been down, a plunge in domestic flight buys, and stagnation of the housing marketplace,” coverage economist Hanna Sakhno, a person of the co-authors, explained to me yesterday.

“These are the items that enterprises provide and shoppers invest in in an financial system, and they have been absorbing the impression. Our tracker reveals a contraction of the Russian economic climate in advance of the official figures launch specifically mainly because we use substantial-frequency indicators from the personal financial system.”

Motor vehicle profits, imports, credit progress, house costs, and other measures all point to a a lot fewer strong regime due to the fact Vladimir Putin’s war on Ukraine started.

Moscow in excess of current months has published secure or even enhanced figures, but the CEPR report indicates declines across the board.

Remember, because February 2022 when Putin launched his “particular military operation” in Ukraine, Western nations have sanctioned the Russian economical program, stifled electrical power flows, and boycotted trade.

Right before then, Russia was the world’s 11th premier financial state — now its oil supremacy is waning and all indicators point to a deterioration in its purpose as a environment electricity.

These 4 charts explain to the story of how war has reshaped Russia around the previous yr.

What do you consider of these indicators of Russia’s economic system? What is your outlook for the war in Ukraine? Tweet me (@philrosenn) or e mail me ([email protected]) to let me know.

In other news:

2. US inventory futures drop early Friday, as buyers hold out for significant financial institutions to kick off earnings time and drop some mild on the economic outlook. Here are the most up-to-date market moves.

3. Significant bank earnings: Citigroup, JPMorgan, Wells Fargo, and BlackRock, all reporting.

4. Inflation slowed drastically in March, but Evercore analysts usually are not certain it truly is an all-very clear for stocks. Top rated stock-picker Julian Emanuel explained his desired names in the existing landscape — and how investors can situation for upside though reducing threat.

5. Brazil would like to conclusion the dominance of the US dollar. In Thursday reviews, President Lula identified as for BRICS nations to use their individual forex: “Who was it that determined the greenback was the forex following the disappearance of the gold conventional?”

6. Financial institution of The usa reported traders must brace for significant cuts to corporate earnings. Firms are modifying to a tougher credit history environment, and that’s going to affect buybacks. The business sees S&P 500 earnings coming in a lot decrease than most consensus estimates.

7. These are the 10 shares most primed for a probable quick squeeze. A short squeeze sends a stock value soaring as shorter sellers — people who wager on a inventory falling — near out shedding positions and buy back shares. See the listing.

8. Real-estate investor Anne Curry manages a 311-device portfolio of attributes. She broke down how she scaled up utilizing the no-funds-down strategy and worked her way up to multifamily specials: “The moment you have the deal, the dollars is tremendous effortless.”

9. Satisfy a 37-yr-aged immigrant who started out with ‘zero credit’ in advance of developing a portfolio of serious estate. Trader Atif Afzal claimed when he very first moved to New York he could not even safe a property finance loan. He shared how he’s given that been able to obtain money independence.

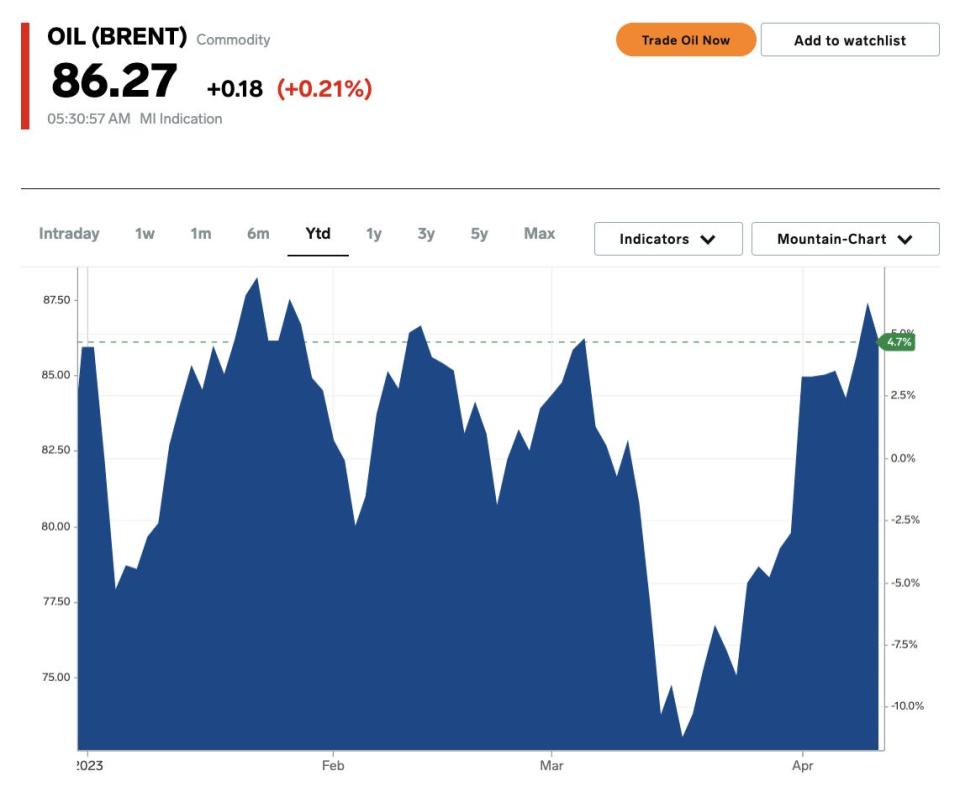

10. Oil markets could see a provide shock of two million barrels a day this 12 months. With OPEC and Russia slashing creation, the global source of crude could confront a steep deficit just before the 12 months ends. At the very same time, oil demand is predicted to hit a history large in 2023.

Curated by Phil Rosen in New York. Suggestions or tips? Tweet @philrosenn or e-mail [email protected].

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read through the original posting on Organization Insider